USD/JPY chart on Trading View used for analysis

- USD/JPY eases off highs, slips from 111.75 to trade at 111.31, down 0.18% on the day.

- Caution seen in the markets ahead of US NFP data due this Friday.

- Upbeat recent data has reinforced the case for two more rate hikes from the Federal Reserve this year, greenback likely to stay buoyed on an upbeat employment report.

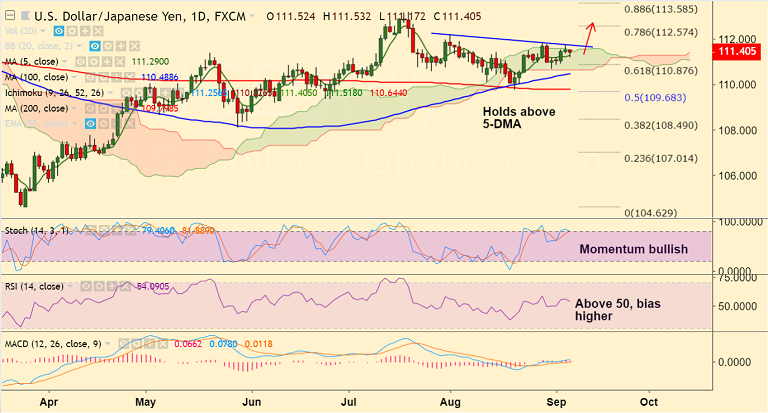

- Price action is struggling to hold break above daily Ichimoku cloud.

- On the downside, 5-DMA offers immediate support at 111.27, break below eyes 61.8% Fib at 110.87.

- Technical indicators are holding a bullish bias and break above 111.75 (trendline and upper BB) will see further upside.

- On the flip side, break below 61.8% Fib will see drag till cloud base at 110.64. Breach below to see further weakness.

Support levels - 111.28 (5-DMA), 110.87 (61.8% Fib), 110.64 (cloud base)

Resistance levels - 111.75 (trendline and upper BB), 112, 112.57 (78.6% Fib)

Recommendation: Watch out for break above 111.75 to go long, SL: 111.20, TP: 112/ 112.55

FxWirePro Currency Strength Index: FxWirePro's Hourly USD Spot Index was at 46.5986 (Neutral), while Hourly JPY Spot Index was at 25.9084 (Neutral) at 0625 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.