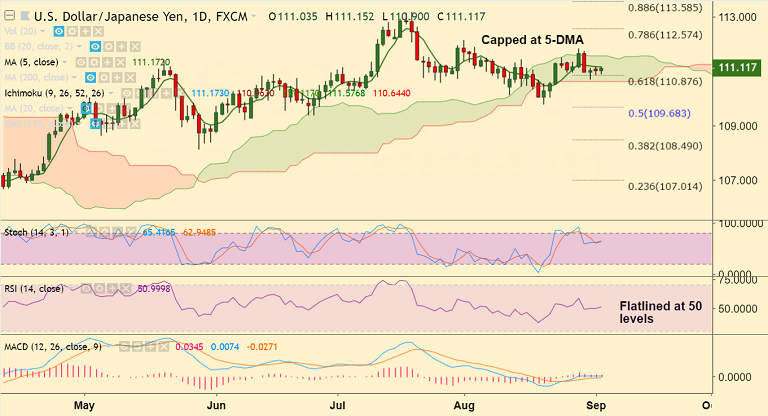

USD/JPY chart on Trading View used for analysis

- USD/JPY extends range trade for 3rd straight session, holds above 111 handle.

- Technical indicators are flat and do not show clear directional bias.

- Price action continues within daily Ichimoku cloud and is holding above 61.8% Fib and 111 mark.

- Upside remains capped at 5-DMA which is immediate resistance at 111.17. Break above 5-DMA finds next resistance at cloud top at 111.57.

- On the flip side, 61.8% Fib at 110.87 is immediate support ahead of cloud base at 110.64. Breach below to see further weakness.

- Focus now on U.S. manufacturing data (PMI and ISM) due later today ahead of the key employment report on Friday.

Support levels - 110.87 (61.8% Fib), 110.64 (cloud base), 110.40 (110-EMA)

Resistance levels - 111.16 (5-DMA), 111.57 (cloud top), 112, 112.57 (78.6% Fib)

FxWirePro Currency Strength Index: FxWirePro's Hourly USD Spot Index was at 5.43661 (Neutral), while Hourly JPY Spot Index was at 114.091 (Bullish) at 0400 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.