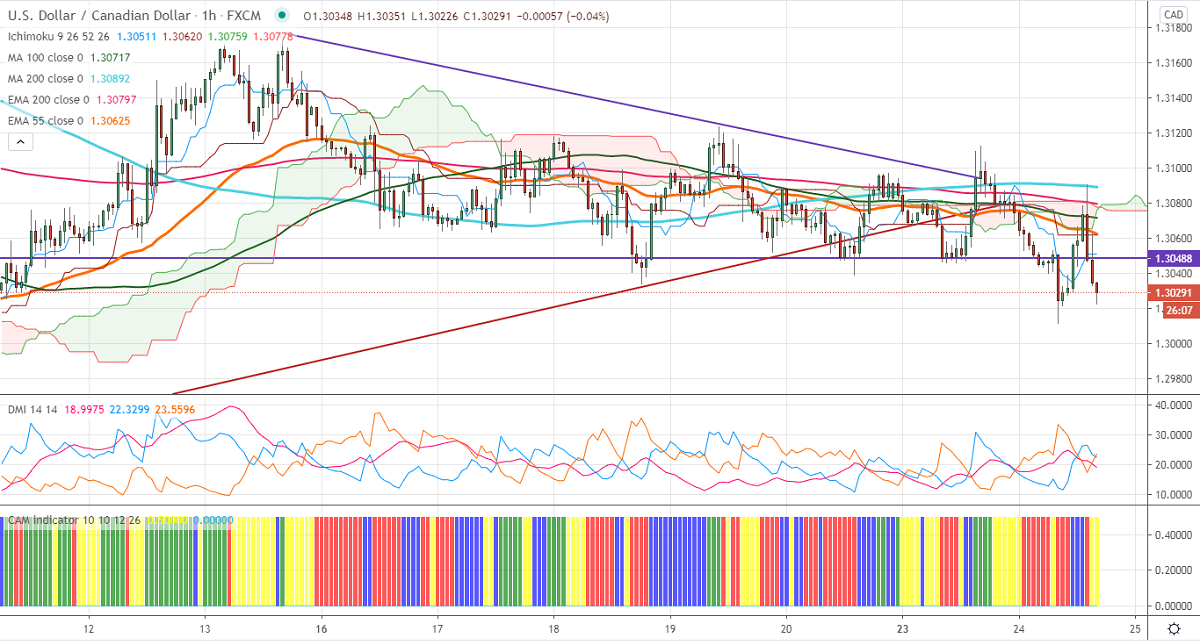

Ichimoku analysis (Daily Chart)

Tenken-Sen- 1.30511

Kijun-Sen- 1.30620

USDCAD continues to trade lower after a minor jump till 1.30900. The upbeat global sentiment due to COVID-19 vaccine optimism and surging crude oil prices is supporting the Canadian dollar. US Conference Board Consumer confidence came at 96.1 in November compared to an estimate of 97.70. DXY is facing strong support at 92, any close below targets 91. Loonie hits an intraday high of 1.30226 and currently trading around 1.30232.

WTI crude oil hits a 3 month high in hopes of a rise in demand due to vaccine hopes. It is holding well above significant resistance 43.75. A jump till 48.80 likely.

Technically, the pair faces near term resistance at 1.3000. Any violation below targets 1.2965/1.2925. The near term resistance is around 1.3060; an indicative break below will take to the next level till 1.3095/1.3175.

It is good to sell on rallies around 1.3048-50 with SL around 1.3090 for the TP of 1.2925.