Intraday bias - Neutral

USDCAD consolidating in a narrow range after a major pullback above the 1.3200 level. The pair gained momentum after upbeat US CPI data. US PPI for August declined by -0.1% in line with expectations. The core producer price index jumped 0.40% vs the estimate of 0.30%.US Dollar index surged more than 200 pips from a minor bottom of 107.68. It hits an intraday high of 1.31844 and is currently trading around 1.31652.

According to the CME Fed watch tool, the probability of a 100 bpbs rate hike in Sep rose to 35% from 0% a week ago.

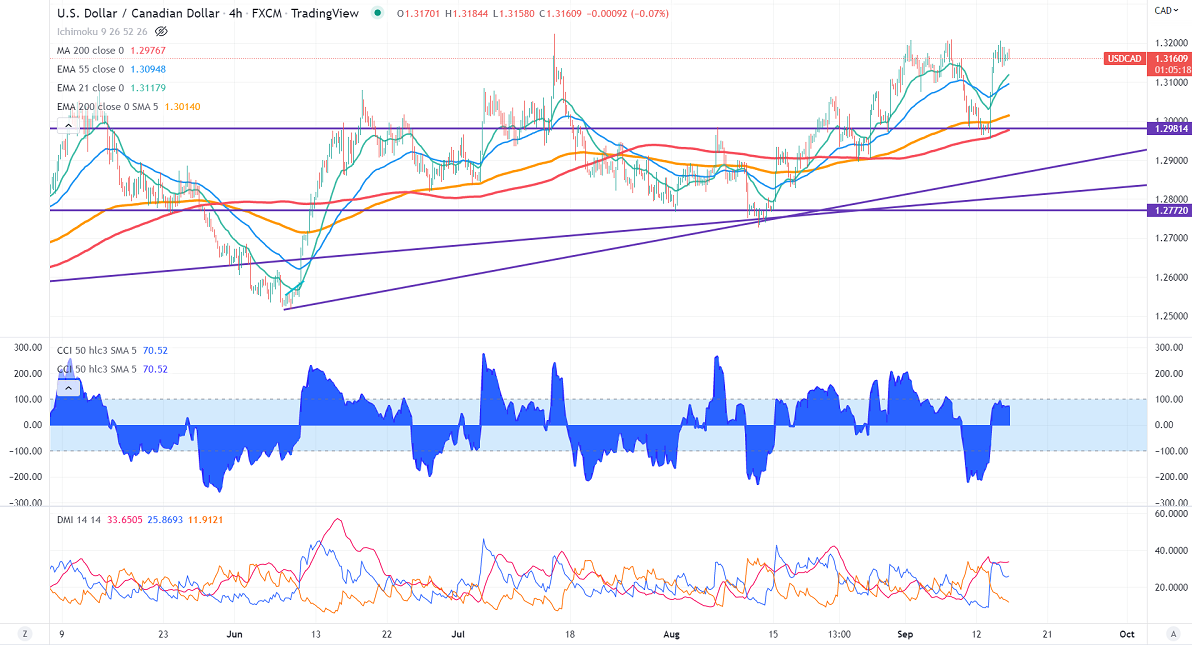

Technically in the 4-Hour chart, the pair is holding above the short-term( 21- EMA), 55- EMA, and the long-term moving average of 200 EMA (1.30031). Any violation above 1.3225 confirms further bullishness. A jump to 1.3300/1.3350 is possible.

WTI crude oil lost more than $4 from yesterday's high of $89.28 on growth concerns. Any breach above $90.50 confirms further bullishness.

The near-term support is around 1.3140, and any breach below targets 1.3070/1.3020/1.2970.

Indicators (4 Hour chart)

CCI (50)- Bullish

ADX- Bullish

It is good to buy on dips around 1.3128-30 with SL around 1.3070 for TP of 1.3225.