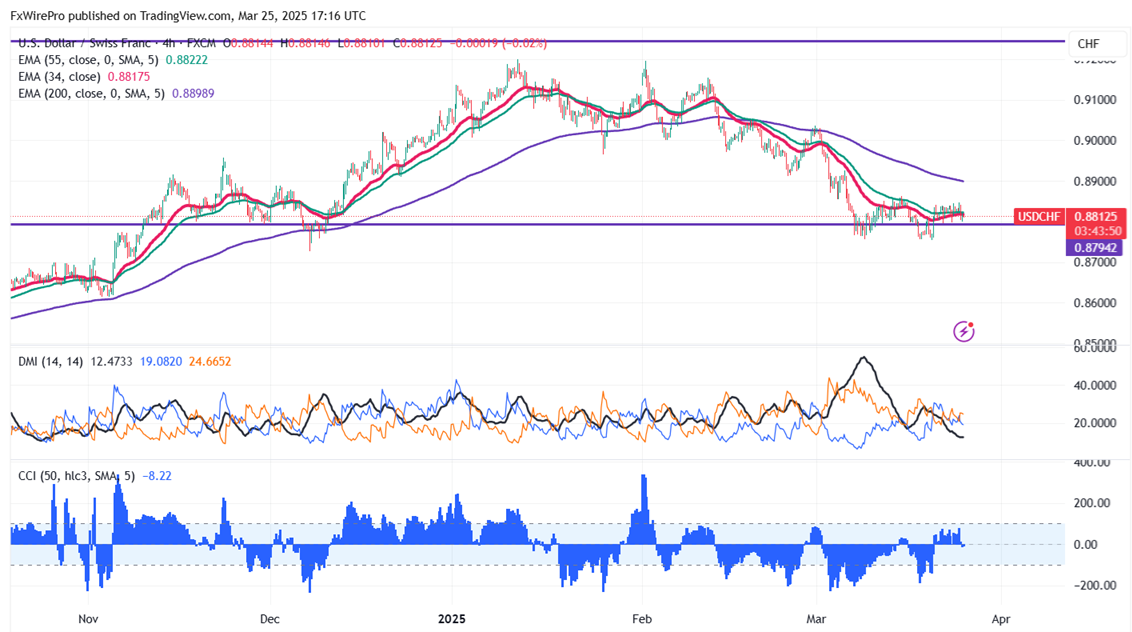

The currency pair is consolidating after a minor sell-off. It hit an intraday low of 0.87995 and is currently trading around 0.88118. The intraday bias appears to be bearish as long as the resistance 0.9000 holds.

The Conference Board Consumer Confidence Index in March 2025 has fallen steeply by 7.2 points to 92.9, the lowest level since early 2021, the fourth month of declining consumer confidence. The Present Situation Index fell 3.6 points to 134.5, and the Expectations Index fell 9.6 points to 65.2, a 12-year low that generally signals a potential recession. The downturn was sharpest among those 55 and older, with tariff and inflation concerns affecting economic sentiment. Median inflation expectations to one year ahead climbed to 6.2%, and the percentage of consumers who believed a recession would persist was at a nine-month high, reflecting widespread economic anxiety

Technical Analysis and Resistance Levels

The pair is trading above the 34-EMA and below 55-EMA on the 4-hour chart indicates a minor up trend. The immediate resistance is at 0.8865 any break above targets 0.8890/0.8940/0.9000/0.9035/0.9070/0.9100/0.9150/0.9200/0.92250/0.9275/0.9300.

Support Levels and Potential Declines

On the downside, near-term support is around 0.8750, any violation below will drag the pair to 0.8720/0.8660/0.8600.

Bullish Indicators

CCI (50) - Bearish

Directional movement Index - Neutral

Trading Strategy Recommendation

It is good to sell on rallies around 0.8850-525 with a stop-loss at 0.8890 for a TP of 0.8720.