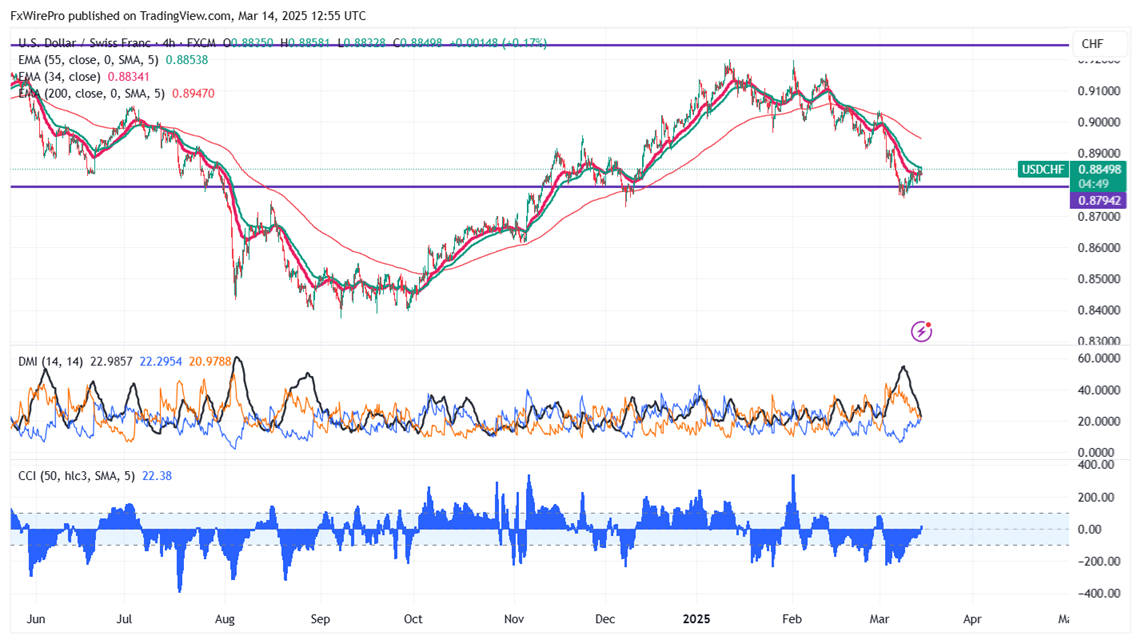

The currency pair showed a minor pullback despite weak US PPI data. It hit an intraday high of 0.88581 and is currently trading around 0.88534. The intraday bias appears to be bearish as long as the resistance 0.9000 holds.

Recent US economic figures show a contrasting picture: initial unemployment claims totaled 220,000, a shade less than the forecasted 225,000, and continuing claims declined as well, signaling that the labor situation is okay. However, the Producer Price Index (PPI) remained unchanged for February, less than expected, the first in seven months, as year-over-year gains declined also. This decline in producer prices reflects an easing of inflationary pressure but also kindles concerns of potentially suppressing demand, inducing uncertainty in economic growth and subsequent policy measures

Technical Analysis and Resistance Levels

The pair is trading above the 34-EMA and below the 55-EMA on the 4-hour chart indicating a mixed trend. The immediate resistance is at 0.8860 any break above targets 0.8890/0.8940/0.9000/0.9035/0.9070/0.9100/0.9150/0.9200/0.92250/0.9275/0.9300.

Support Levels and Potential Declines

On the downside, near-term support is around 0.8780, any violation below will drag the pair to 0.8720/0.8660/0.8600.

Bullish Indicators

CCI (50) - Neutral

Directional movement Index - Neutral

Trading Strategy Recommendation

It is good to sell on rallies around 0.8850-525 with a stop-loss at 0.8890 for a TP of 0.8720.