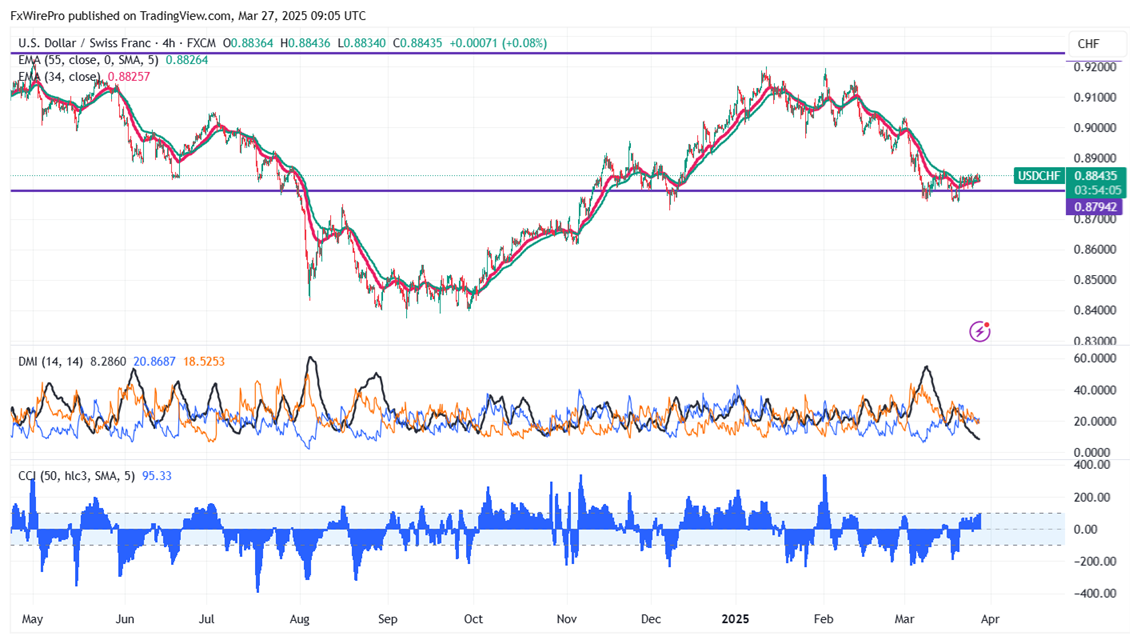

The currency pair is consolidating after a minor sell-off. It hits an low of 0.87985 this week and is currently trading around 0.88357. The intraday bias appears to be bearish as long as the resistance 0.9000 holds.

U.S. Core Durable Goods Orders fell 0.3% in February 2025, the first fall in four months, but overall Durable Goods Orders rose 0.9% to $289.3 billion, exceeding expectations after rising 1.5% due to an increase in transportation equipment, which was dominated by a 4% rise in motor vehicles and parts. A decline in core orders, which excludes transportation, shows that businesses may be restraining themselves from accelerating capital goods purchases amidst uncertainties on tariffs and the economy.

Technical Analysis and Resistance Levels

The pair is trading above the 34-EMA and below 55-EMA on the 4-hour chart indicates a minor up trend. The immediate resistance is at 0.8865 any break above targets 0.8890/0.8940/0.9000/0.9035/0.9070/0.9100/0.9150/0.9200/0.92250/0.9275/0.9300.

Support Levels and Potential Declines

On the downside, near-term support is around 0.8750, any violation below will drag the pair to 0.8720/0.8660/0.8600.

Bullish Indicators

CCI (50) - Bullish

Directional movement Index - Neutral

Trading Strategy Recommendation

It is good to sell on rallies around 0.8850-525 with a stop-loss at 0.8890 for a TP of 0.8720.