The AUDNZD has shown a steep slumps from the highs of 1.0970 to Friday's lows of 1.0643, currently spot FX is at 1.0685 with some bearish pressure. At the highs of 1.0970 we had traced back to back shooting star patterns to have bearish stance on this pair and that is when we had advocated option strips strategy on 29th Jan, rest is history by now.

We would like you to go through our previous write up to brief the recommendation on option strips strategy advised on 29th Jan.

http://www.econotimes.com/FxWirePro-ATM-puts-in-AUD-NZD-option-strips-add-leveraging-effect-in-speculation-151844

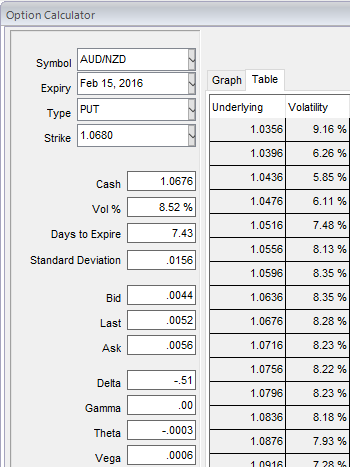

Let's suppose, as shown in the diagram, we have vega of at the money AUDNZD put option at 0.0006 with implied volatility at 8.52% while spot FX is now trading at 1.0685.

This would mean that the chances of upside risks of option prices to reduce if the underlying price rallies and the other way round. So what we had in previous positions should be squared off, book profits and stay short with diagonal bearrish strategic positions as there might be little spike in near terms.

Option premiums behave with this reasoning, vertical bear put spread strategy is employed when the options trader thinks that the price of the underlying AUDNZD will fall reasonably in the near term but within a bracket of 3% downward range, while IVs are crawling in snail's pace at 8.52%.

Rationale: Always remember the option's delta and vega would have the huge impact on a long put position should the market bounce.

So the recommendation would be "long vertical put spread" that will cut down the exposure you have against dubious rallies in anyone's mind, but more significantly it will also reduce the exposure you have to Vega, the relative effects of volatility on the option prices.

One way of minimizing the avid appetite with a naked long put has for your precious capital is to spread much of the risk by using vertical spreads.

Hence, we constructed the above strategy by shorting 2W (-2.5%) deep Out Of The Money put with positive theta values, while simultaneously going long in 2% in the money -0.71 delta put option with the same maturity so as to turn vega into correspondingly positive.

FxWirePro: Unload weights in AUD/NZD strips to book profits, stay calm with diagonal debit put spreads

Monday, February 8, 2016 5:25 AM UTC

Editor's Picks

- Market Data

Most Popular

5