The ETF traders are girding for increased volatility with the postelection rally in U.S. stocks stuck in neutral.

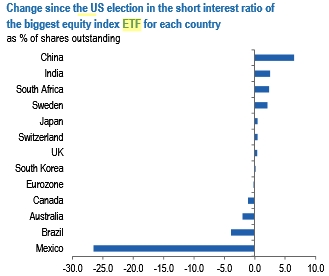

HFs manage to deliver positive alpha in 2016, for the first time since 2013. But to proxy the shifts in investor positions across equity indices we look at the change in the short interest of the biggest equity index ETF for each country. These ETFs are typically domiciled in the US. To proxy the shifts in investor positions across currencies we look at the change in the net spec position of each currency’s futures contracts as reported by CFTC. The changes in these position metrics since the US election are shown in above figures.

Fresh consideration is driving into exchange-traded funds linked to the CBOE Volatility Index at the fastest rate in three months. Meanwhile, traders are selling ETFs that profit when the VIX falls.

Recent history shows those two trends offer a worrisome sign for stocks in the weeks ahead.

VIX ETFs are linked to the futures on the market’s so-called fear gauge, which measures the price investors are willing to pay for “insurance” in the form of options. To buy a VIX fund is tantamount to a bet that stocks will fall, as the gauge generally spikes when stocks are declining.

Betting on higher volatility has been a losing bet in recent months but traders last week pumped the most money since October, $204 million, into the iPath S&P 500 VIX Short-Term Futures ETN. It's the biggest VIX-tracking fund on the market.

Traders can also bet on market tranquillity by targeting products which “short” the VIX. This trade, which has been a winner, has fallen out of favor recently. Some $60 million was pulled last week from the Velocity Shares Daily Inverse VIX Short-Term ETN, which profits when volatility goes down. That was the largest outflow from the product since the final week of 2016, according to FactSet.

Sharp swings in VIX fund flows have recently been a reliable indicator the VIX will rise, says Jason Goepfert at Sundial Capital Research. This is the fourth time in six months that money has moved into VIX-tracking ETFs and out of "short" VIX ETFs so swiftly.

In October, the VIX shot above 22 from 16 two weeks after comparable flows into and out of the same VIX-related funds. Small, brief VIX pops materialized in November and December after this signal was triggered as well. When there is a large swing into funds betting on a higher VIX, it almost always accommodates.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX