We could foresee the bulls taking halt at this point, this has been confirmed with a hanging man candle formation on weekly chart at 1.3084. Hanging man is a bearish candle but there was no clarity from leading oscillators even though both RSI and stochastic reached overbought zones.

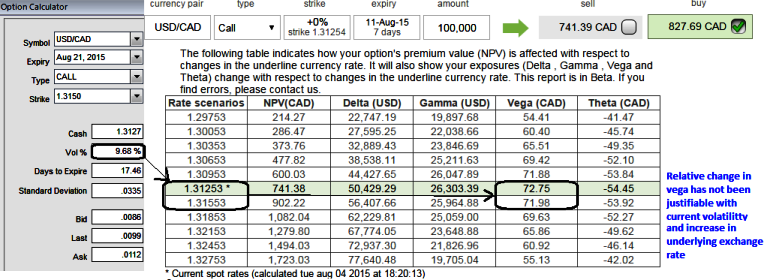

We think shift in vega has npot been justifiable with corresponding increase in exchange rate while volatility is perceived at 9.68% which is on higher side. Shift in Vega on Long ATM call was from 72.75 to 71.98.

So for now sell near month out of the money call and buy back far month ATM call. The diagonal bull call spread involves buying long term calls and simultaneously writing an equal number of near-month calls.

This strategy is typically employed when the options trader or hedger is bullish on the underlying pair over the longer term but is neutral to mildly bearish in the near term. It may even be possible at some point in time to own the long term call with no cost or negligibale cost.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate