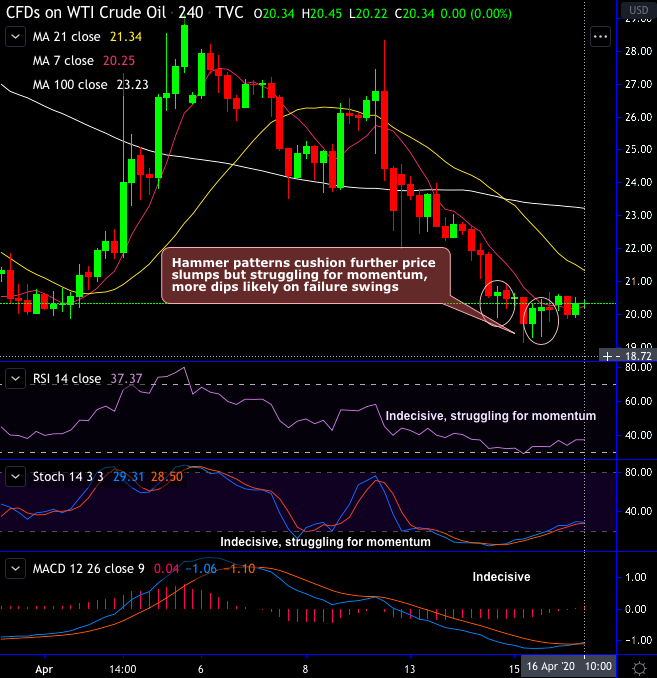

After WTI crude’s price slumps to $19.29 levels which is 18-years lows, it hasn’t gone anywhere from the last couple of days, the energy commodity has been oscillating around $20 - $20.50 price band.

Technically, despite the hammer patterns occurrence at the bottom, crude's price consolidation looks vulnerable (refer daily chart). For now, no traces of recovery is observed after stern bearish candles, as both leading oscillators (RSI & Stochastic curves) substantiate intensified selling momentum, the trend indicators also substantiate the current downtrend.

While on a broader perspective, the major downtrend tumbles below crucial supports & hits 18-years lows. Amid this journey, the bears have retraced 88.6% Fibonacci levels from the 2018 highs and 2016 lows (refer monthly chart). While both leading & lagging oscillators in tandem with price slumps.

Hence, on trading grounds, tunnel spreads are suggested using upper strikes at 20.70 and lower strikes at 19.70 levels.

Alternatively, we advocated shorts in CME WTI futures contracts of far-month tenors with a view to arresting further dips, since further price dips are foreseen we would like to uphold the same strategy by rolling over these contracts for May month deliveries.