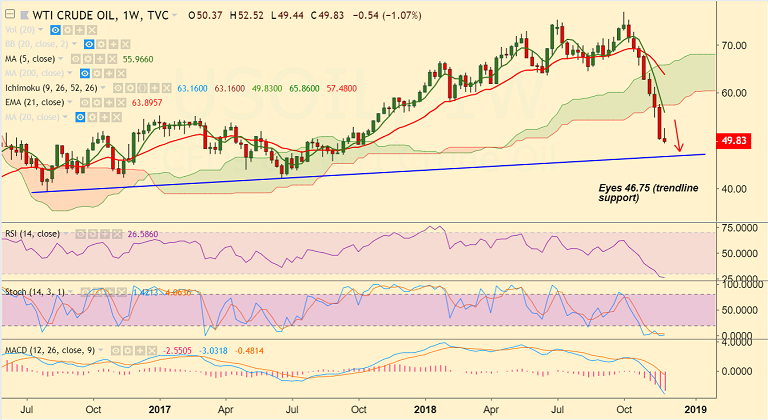

WTI chart on Trading View used for analysis

- WTI has breached the key $50 level to hit lowest since October 2017.

- The black gold was sold-off aggressively as markets remain skeptical ahead of the OPEC meeting next week.

- There are renewed concerns whether the OPEC will fail to deliver on the expected output cuts to stem the price declines and supply overhang.

- Also, increased cautiousness ahead of Friday’s Trump-Xi meeting on trade keeps the black gold on the defensive.

- Next bear target lies at 49.13 6th October 2017 lows. Further weakness could see 46.49 (Sept 2017 low).

- Immediate resistance is seen at 5-DMA at 50.85, Decisive break above 20-DMA to see some respite from bears.

Support levels - 49.13 (6th October 2017 lows), 46.75 (trendline), 46.49 (Sept 2017 low)

Resistance levels - 50.85 (5-DMA), 53.43 (50M SMA), 56.33 (21-EMA)

For details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025