EMFX vulnerabilities: Clinton is leading in the polls but the US election outcome is far from certain. Investors should consider a Trump hedge in their portfolio.

EMFX candidates: The major stress point is the MXN, but even with the recent rally there is quite a bit of risk premium still embedded in the currency. This is evident in positioning, medium term performance versus the rest of EMFX, cheapness compared to oil, and the pronounced kink in the vol term structure.

More uncertainty is that, “What Mr Trump was saying and doing revealed a character and temperament unfit for the leader of the free world,” Mitt Romney, 28 May, Wall St Journal Above and beyond concerns about the specific policies that the potential president Trump might put in place.

EM currencies could react to the uncertainty over these policies – and candidate Trump’s track record for changing his mind.

EMFX Trump-vulnerability index analyses five considerable factors (trade, security, local reaction, sentiment, and the US rates) to identify which EM currencies might suffer the most in the event of a Trump victory. The MXN, TRY, KRW, and TWD feature at the top of these rankings, while the ZAR and MYR show a strong historical relationship to polling data.

Asymmetric risk profile: There is not much of a risk premium, if any, priced into these currencies, so in a Clinton win they are unlikely to strengthen much or experience meaningful declines in implied volatility.

However, in a Trump win, the risk premium in uncontaminated EMFX should broaden significantly beyond the peso.

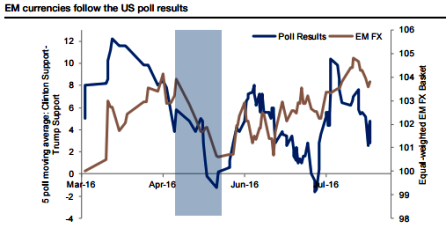

EM currencies appear to be clearly vulnerable to US politics. The above graph explains the relationship between Hillary Clinton’s poll lead over Donald Trump (in blue) and a blended index of EM currencies (in brown). Between late April and mid-May, when Clinton’s eight-point lead became a one point lag, the FX currency index lost a little over 3% against the dollar.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?