The latest figures on German gross domestic product (GDP) are far from reassuring. Output was 0.3% lower in 2023 than the year before, turning Germany into the worst-performing large economy in the world.

By comparison, the International Monetary Fund (IMF)‘s latest calculations show the US economy growing 2.1% in 2023 and China 5%. The European Union as a whole achieved 0.7%, dragged down by Germany, its largest contributor.

Germany has been hit hard by the rise in energy costs, especially having relied almost entirely on cheap Russian energy until Russia’s invasion of Ukraine in 2022. Sizeable inflationary pressures have put pressure on German companies’ production processes, which are optimised for efficiency.

Rising interest rates have made it harder for German companies to secure financing, as well as increasing their operating costs and weakening domestic and foreign demand.

And China has slowed down and also started to invest in self-sufficiency, reducing its dependence on foreign technology and the import of foreign products and services. This is clearly a problem for German companies that have relied massively on the Chinese market over the past two decades.

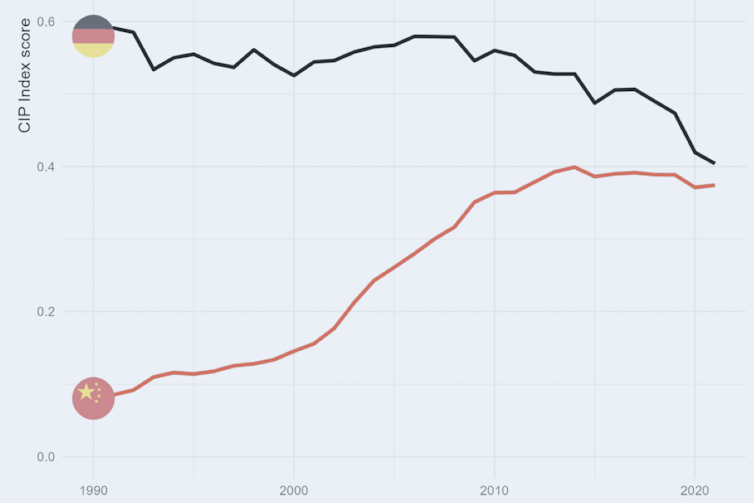

According to the UNIDO Competitive Industrial Performance (CIP) Index, Germany remains the world’s leading manufacturer, having maintained the top rank since 2001. Yet China has entirely filled the gap over the past years, as illustrated below.

German vs Chinese manufacturing

The UNIDO index measures countries’ capacity to produce/export manufactured goods, technological progress and global influence on manufacturing.

The results of the IMD World Competitiveness Ranking confirm that Germany has been losing ground among top economies. Ranked 15th overall in 2022, it dropped seven positions in 2023, deteriorating across all the dimensions considered in the ranking: economic performance, business efficiency, government efficiency and infrastructure.

So what can be done for Germany, at a time of huge geopolitical friction and with many countries adopting industrial policies to distort and limit trade to protect local industries? Three strategic priorities stand out:

1. Diversify, diversify, diversify

Germany must fix its over-reliance on China as its biggest trading partner. China has been Germany’s most important trading partner since 2015, and trade between the two countries rose to a record level in 2022.

Berlin has recognised its excessive dependence on China for some time, but manufacturing footprints take time to change, and it can’t be done without a fallout in terms of economic performance.

Take Volkswagen. It remains a major player in China with around 3 million vehicles sold a year, but it was selling over 4 million units as recently as 2018. This is because China’s swift transition to electric cars has benefited local players like BYD.

The market share of foreign cars in China has fallen from 64% in 2020 to 44% in 2023. The challenge for German companies like Volkswagen is to transform this into an opportunity for greater diversification.

Diversifying while maintaining existing trade and investments in China will be difficult, however, as we should expect the Asian country to charge a higher price to foreign companies for the access to its domestic market. Yet at such a time of geopolitical uncertainty, diversification must be the first strategic priority.

A recent study from the German-based Kiel Institute for the World Economy suggests that if there was an abrupt halt to trade with China, it would cause Germany’s economy to shrink by 5% – a slump comparable to the global financial crisis or the COVID-19 pandemic.

2. Borrow to invest

In 2009, Germany added a “debt brake” to its constitution. The rule, which severely restricts Germany’s ability to borrow and run deficits, was seen as incentivising sensible spending and ensuring that the public finances would remain healthy.

This became the mantra used by Angela Merkel and the so-called Troika of the European Commission, European Central Bank and IMF in the years following the global financial crisis as Greece and other countries struggled with their debts.

The landscape has now fundamentally changed, however. Germany’s constitutional court recently blocked the transfer of €60 billion (£51 billion) from a pandemic budget to a climate fund precisely because of the “debt brake” clause. This has led to a budget crisis that is yet to be resolved.

More generally the debt brake has become a major challenge because Germany, and the EU as a whole, are competing against other countries that are subsidising their companies. For instance, Brussels recently launched an investigation on the likely presence of major market distortions resulting from Chinese state subsidies in the automotive sector.

The only way forward for Germany is to invest heavily in infrastructure, research & development (R&D), and more efficient state operations to help companies transform themselves and stay competitive globally. To finance this, greater reliance on debt is unavoidable.

3. Attract investments from abroad, bet on Europe to innovate

Recent Bundesbank figures show that foreign direct investment in Germany decreased to €3.5 billion in the first half of 2023 from €34.1 billion in the same period in 2022. This is a dramatic fall and the lowest inflow figure in almost 20 years. It calls for careful reflection on Germany’s loss of competitiveness and its ability to attract foreign investment.

The only way to fix this downtrend is to bet on innovation driven by EU-led R&D investments. Innovation has long been the engine of German (and EU) economic performance. Germany is one of the highest spenders on R&D in the bloc, at slightly over 3% of GDP per year.

Yet this is in the same ballpark as a decade ago, while the US and Japan now invest close to 3.5% of GDP. Stepping up R&D and keeping pace with the latest technological developments is a must for Germany (and the EU).

In a world where countries from China to the US are increasingly subsidising their corporations, and enacting policies to protect their local economies, Germany must make long-term investments in infrastructure, government efficiency and stimulating corporate ecosystems. This will attract greater investment from abroad, which will be crucial for Germany and its EU counterparts to innovate and thus stay competitive in the global arena.

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out