Short USD 6M 10y receivers call, 50 bps out of the money options on bonds, or equivalently.

Sell receivers swaption on rates an option seller is naturally short volatility.

But in a bear market when prices are declining strongly, the delta of the option rapidly vanishes.

We used Sharpe single index ratio in order for calculating risk-adjusted return.

On the other hand, the premium collected by selling the call systematically also increases as the volatility increases in a bear market.

So, the strategy that consists of selling calls is generally a good hedge against market downturns.

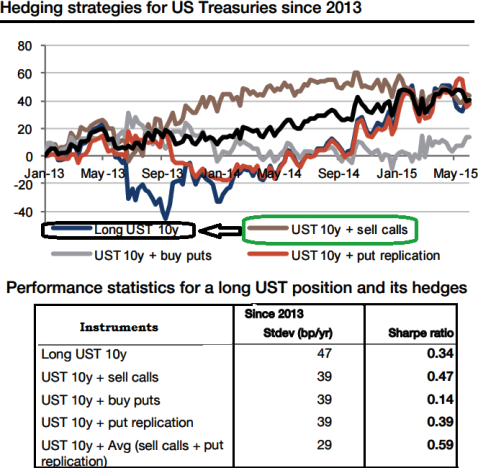

As you can make out from the chart that brown curve represents the option combination of longs on 10Y UST plus Shorts on 6M OTM Calls. This is effectively performing from last one & half years well above naked underlying position that is shown in the diagram blue curve in colour.

The fund manager who has been running such systematic hedging strategies would have been paid more than half of the gain in return for a reduction in volatility of just one third including costs.

In terms of risk-adjusted performance, the Sharpe ratio of a long position in US Treasuries was 0.34, and the best that we could achieve with a systematic strategy is 0.47.

We tend to interpret this number as healthy, because generally the greater the value of the Sharpe ratio, the more attractive the risk-adjusted return.

Hedge US treasury bonds shorting on OTM calls

Tuesday, June 9, 2015 12:10 PM UTC

Editor's Picks

- Market Data

Most Popular