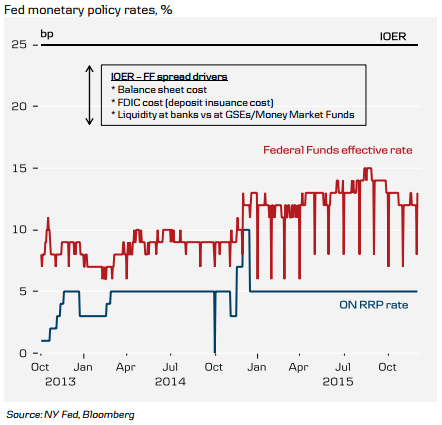

The U.S. Federal Reserve is holding more bonds; as a result, total USD reserves in the Fed funds system have increased to USD 2,500 billion, which is more than reserve requirement. The depository institutes, who have reserve accounts with the Fed, are earning the interest rate on excess reserve (IOER) at 0.25%.

The Fed rate hike may increase a scope for the depository institutes to arbitrage out the spread between Fed fund rate and the IOER. They will barrow in the Fed funds market and save in IOER. Therefore, Fed should fix the funds rate at a margin to the IOER, suggests Danske Bank.

Higher Fed funds rate may raise arbitrage

Tuesday, December 8, 2015 5:12 AM UTC

Editor's Picks

- Market Data

Most Popular

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022