The Fed has disappointed markets by failing to deliver the higher fed funds target rate for the best part of 2015 and 2016. FOMC statement from the latest November meeting showed that members wanted ‘some further evidence’ that the economy was moving in the right direction. Trump victory and the resulting inflation expectations will likely keep the Fed more hawkish.

Initial sell-off in the financial markets after the surprise Donald Trump victory in the presidential election has now given way to the belief that Trump will boost growth through infrastructure spending and tax cuts. This has led to higher inflation expectations, higher US yields and consequently a repricing of Fed rate hikes.

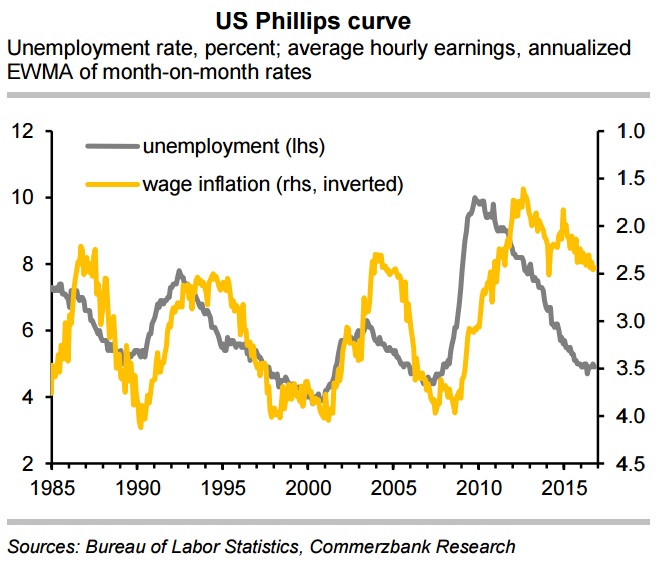

There are clearer signs that wage growth is now starting to pick up. With an unemployment rate close to 5 percent and continued employment growth close to 200,000 persons a month, U.S. labour market remains tight. Wage inflation has already been on a decent upward trend. However, given the tight labor market situation, wage inflation was still disappointing compared to former business cycles. Rising inflation expectations might quickly lead to actual inflation, enabling the Fed to raise rates faster than expected earlier.

"Our US economists now assume 2.3% inflation (in terms of the Fed-relevant core PCE measure) in 2017 and further acceleration in 2018. I think it is fair to assume that the Fed would prefer higher interest rates," said Commerzbank in a report.

Markets have more or less fully priced in a Fed hike in December and more than two hikes from now until year-end 2017. Ten-year US treasuries are now trading at 2.2 percent, the highest level since year-end 2015 and the US 5Y5Y inflation expectation has risen to 2.4 percent.

"US yield curve can steepen further in the coming months and we expect both 2Y5Y and 2Y10Y spreads to rise. Over a 6M-12M horizon, we expect the steepening trend to end as short-term yields begin to catch up," said Danske Bank in a report.

USD/JPY was trading at 110.34 and EUR/USD was trading at 1.0622 as at 11:00 GMT. At the said time FxWirePro's Hourly EUR Spot Index was at -11.7344 (Neutral), Hourly JPY Spot Index was at -41.6712 (Neutral) and USD Spot Index was at 47.7567 (Neutral).

For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure