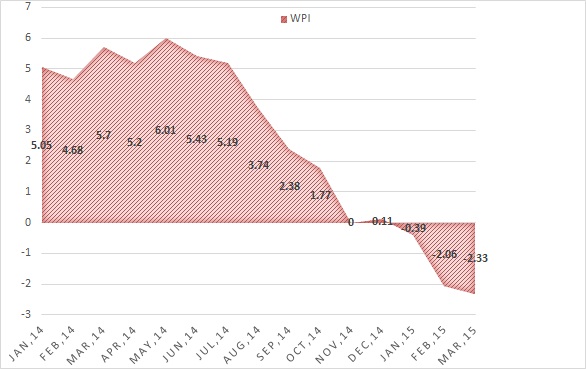

Today India's Wholesale price Index was published that showed signs of continued disinflation.

- WPI is an important piece of data watched closely by Reserve Bank of India (RBI). It provides information of price pressure across mandis or whole sale market.

- India over the years continued to suffer from high inflationary pressure and deteriorating trade deficit.

- Since fall in oil price from mid-2014, price pressures have somewhat abated in India. Current account balance also improved with fall in oil price and with introduction of high import duties to curb gold imports.

- February trade deficit fell to $ 6.8 billion from previous $ 8.32 billion.

- February WPI fell by -2.06% from previous -0.39%.

Impact -

- RBI already introduce two rate cuts this year each of 25 basis points. Current repo rates stand at 7.50%.

- Today's data points at more room exists to cut rates further by RBI. It's interesting to see how RBI reacts over the falling inflation which acted quite rapidly this year out of its usual policy meeting. RBI either may choose to ignore the effect of oil price on falling inflation as FED rate rise looms large at horizon or cut rates further rapidly and choose the path of competitive devaluation through reduction of rates further to reign over disinflation.

- IMF's chairperson lagarde in recent comments mentioned India as a bright spot in cloudy global horizon.

- Rupee appreciated against dollar today, benefiting from global flow of fund into the bond market as speculation rise over further rate cuts. INR is trading at 62.8 against dollar, up 0.3% today.

- Country's stock market is expected to do well too but concerns rise as weaker euro and other East Asian currencies along with struggling oil producers to hurt exports from India.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary