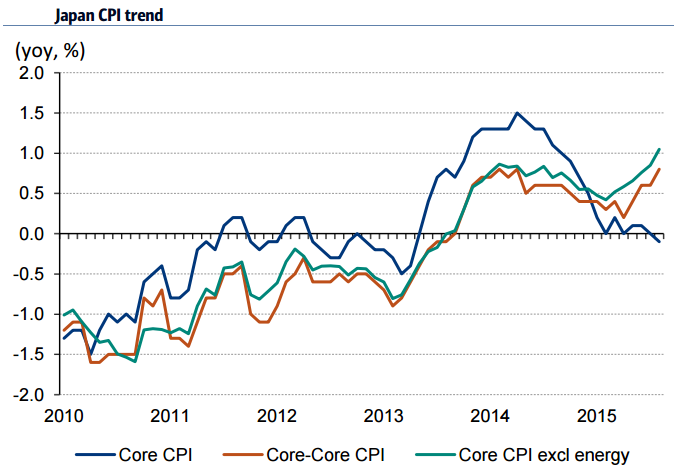

The BoJ is implementing its current policy of quantitative and qualitative easing (QQE) to achieve its price stability target of 2%. Accordingly, any discussion of interest rate normalization must begin with the price outlook. Recently, declines in energy prices and increases in food prices have been offsetting each other, and the core CPI (which excludes fresh food and is the inflation measure used by the BoJ), has dropped to around 0% YoY, which is far from the 2% target. Nevertheless, the BoJ expects prices in Jul-Sep to stay around 0% because of the decline in energy prices, and that is already reflected in the market as a result of recent moves. This means the key question is to what extent will the core CPI grow in Oct-Dec, when the negative impacts from YoY declines in energy prices start to narrow.

Additionally, how much the inflation rate accelerates will depend on the level of improvement in the core-core CPI, which excludes food and energy prices and is heavily affected by wages and exchange rates. Given the results of the spring wage negotiations, the rising trend in SME wages, and the roughly 10% weakening of the yen since 2H14, the core-core CPI is expected to gradually gain upward momentum approaching 2016. Because the effects from yen depreciation will continue into 2016, food prices are also likely to continue making a positive contribution to inflation. In fact, the core CPI excluding energy (which is the same as the core-core CPI with non-fresh food prices added back in) has been showing strong growth.

"Our forecast for core CPI YoY growth is 0.0-0.1% in Jul-Sep 2015, followed by a rebound to 0.7-0.8% in Oct-Dec in step with the narrowing of YoY declines in energy prices, and then an increase to 1.4-1.5% by 1H16. Even if our scenario unfolds as we expect, however, inflation will not reach 2%. Achieving the 2% inflation target will probably require continued wage increases", notes BofA Merrill Lynch.

Japan's CPI outlook

Monday, September 28, 2015 8:54 PM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed