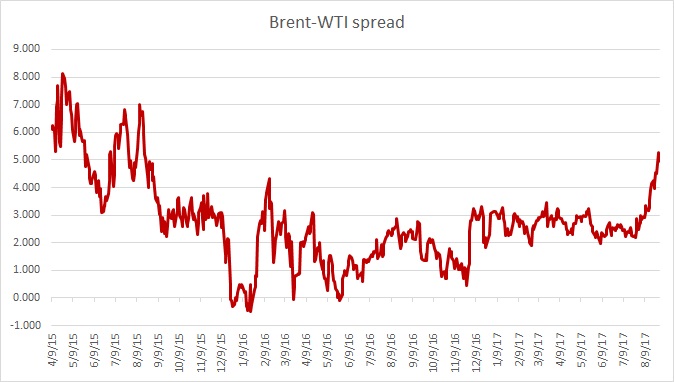

In the latest up bullish leg that began in June this year, the North Sea benchmark Brent has been a much better performer than the WTI. After bottoming around $42 per barrel, the North American benchmark WTI has gained more than 10.7 percent, while Brent has gained more than 15 percent. The outperformance of Brent over WTI had already pushed the spread (Brent-WTI) from $2 per barrel to $4.2 per barrel last week, which was the highest level for the spread since February last year when the oil price made an important bottom around $27 per barrel.

Now, this week’s hurricane Harvey has pushed that spread higher as it batters the important Texas coast and Louisiana. Harvey is the most powerful hurricane in more than 50 years and caused historic flooding. ExxonMobil shut down its Baytown refinery, the second largest in the United States with a capacity of 560,500 barrels per day. Royal Dutch Shell closed its 360,000 barrels per day Deer Park refinery, according to S&P Global Platts, and Phillips 66 shut down its 247,000 barrels per day Sweeny refinery. All port facilities in Houston and Corpus Christi were also shut down on Monday, not open to vessel traffic, which means that no refined products or crude oil will be either imported or exported for the time being.

As the produced crude remains landlocked, away from refineries, the demand for WTI is in decline. The spread (Brent-WTI) reached $5.4 per barrel this week, which is the highest since August 2015.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed