Back in the summer of 2014 and throughout 2015, when the oil price was declining rapidly, it was thought that lower oil price would lead to very large declines in production from the United States, which at that time was breaking into new record highs. This view got somewhat reinforced with a very sharp decline in the number of oil rigs operating in the United States. The Number of active rigs declined from 1609 in October 2015 to just 316 by May 2016. At the same time, the oil production in the United States declined from 9.6 million barrels per day in August 2015 to 8.43 million barrels per day by July 2016.

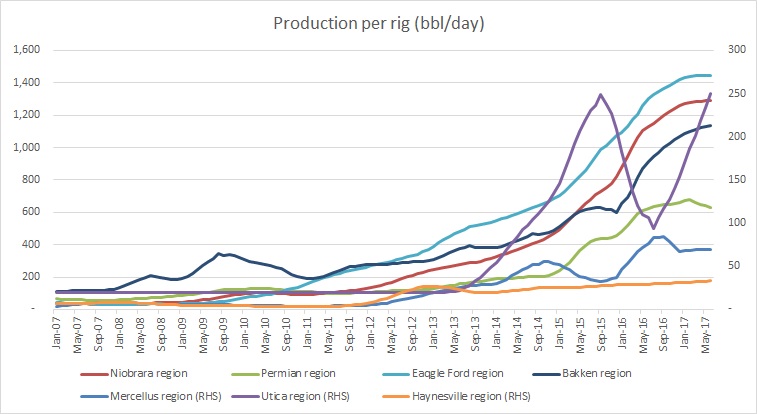

While the analysts were predicting a further decline in production as the oil price was hovering below $50 per barrel. However, despite fewer rigs operating the oil production has started recovering in the United States and as of latest report, it is closing in on its record high. It currently stands at 9.32 million barrels per day. Largely, the credit for the recovery, despite a fewer numbers of operating rigs goes to the increased efficiency of production. Since the decline in production back in 2014 summer, the production per rig, which is a measure of efficiency has more than doubled in some regions like Bakken, Eagle Ford, Niobrara, and Permian. The increased efficiency pose a major threat to the oil price recovery as the lower price has clearly failed to bring down the production. Refer Chart.

Recently, some analysts have been pointing that the efficiency curve is flattening for many regions and in some cases like Permian, it is in decline. However, one must take note that when oil price was down far more than $50 per barrel, the producers were only operating the most efficient rigs but as the price rose and more rigs are coming into operation, it is natural for the efficiency would decline. The numbers of operating rigs have more than doubled since its bottom back in May.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX