Recently news of slowdown in non-OPEC oil production has been circling crude oil market as Oil Producers' cartel OPEC and international energy watchdog IEA both announced that production is likely to drop this year and next. Report also shows that US shale oil producers' in spite of reducing cost is in deep financial trouble due to lower prices and lower price from longer is likely to push many producers towards bankruptcy. There has already been close to 25 bankruptcies this year in US in relation to energy sector.

Market also focused on high demand from China, in spite of its economic slowdown.

However, calling a reversal based on these facts might lead only to misery as global inventory is at such levels that it could be many months before there can be any significant shortage.

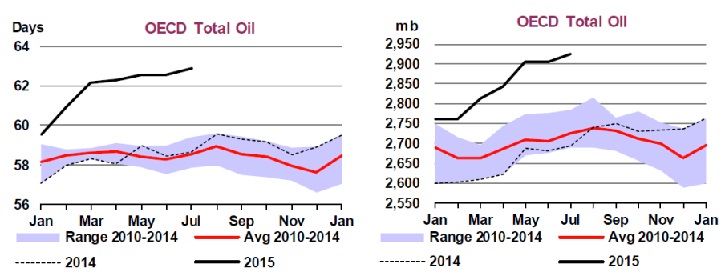

- OECD oil inventories have never been higher in history and it is still rising. Inventory at end of July was 2950 million barrels according to data from IEA. That means at current demand they are sufficient to cover 63 days for overall OECD. Days cover running highest in Europe at 68 days and cover is way above average in both Asia and US.

- Demand from China can also be misleading, at it is filling up its strategic reserve throughout the year at 380,000 barrels per day.

With such high inventory marginal drop of 100,000-200,000 barrels/day drop in US production can hardly matter when speaking longer term.

- Moreover, US output rose by 1.7 million barrels/day last year and it may not diminish by much with congress fighting over lifting US export ban. Saudi Arabia is still pumping over 10 million barrels/day and Russia pumping at highest pace since Soviet era.

- All this is large enough to IEA estimated demand rise of 1.8 million barrels/day this year and should be enough to compensate additional demand of 1.2 million barrels/day next year.

According to IEA estimate, demand growth is unlikely to overwhelm given the weakness in global economy.

To add to the mix, we are not forgetting Iran, are we!

- Iran is expected to increase output by 1.5 million barrels/day by end 2016. And this supply is more likely to rise than not. It might even surpass that. Foreign investment in oil is likely to flow in Iran's oil sector given the low cost of production associated.

Though reduction in investment at the sector puts future supply crunch possibilities but that still seems to be quite a distant future given the weak demand growth of today.

We are in an era of low oil price, which is likely to persist for now.

Chart courtesy ICIS, think tank and intelligence provider in chemical industry.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand