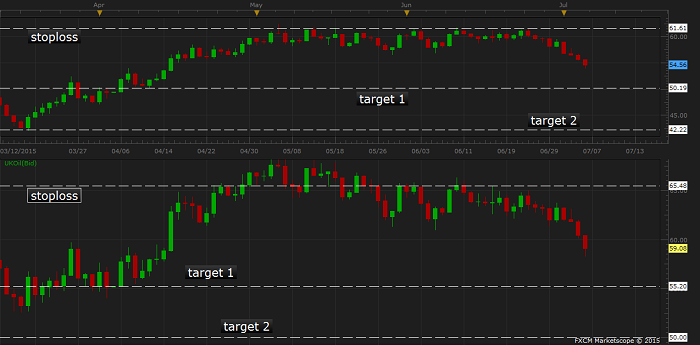

Since oil failed to break above the congestion and WTI benchmark failed to clear above doji high, it is breaking to the downside.

WTI crude -

WTI oil is currently trading at $54.5/barrel, down after it failed to clear above $62.4/barrel, the doji high. This downside break is of high importance, since oil has broken 8 weeks of consolidation.

As suggested in earlier post, first target for WTI is around $50-51/barrel, however a retest of the March low around $40/barrel as of now can't be ruled out.

Stop loss for the longer trade can be kept around $62.5/barrel. Risk-reward still remains favorable to enter position.

Brent crude -

Biggest risk posing for Brent crude is nuclear deal among Iran and world powers, which could open up large amount of supply to already oversupplied market. Brent is currently trading at $59/barrel.

As suggested in earlier post, initial target for Brent is at $55/barrel area, however it is likely to reach as low as $50/barrel area.

Stop loss for Brent trades lies at $65/barrel area.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings