People's Bank of China (PBOC) over the weekend taken steps to provide further relief to debt burden and ailing economy.

PBOC this year has been quite aggressive in easing so far this year, however Friday's 7% drop could have prompted the bank to take action over the weekend as Greek failed negotiation clouded sentiment.

- The level of action had been quite rare. PBOC had cut both of its benchmark rates and also reserve requirements. PBOC has cut one year benchmark lending rate and deposit rate by 25 basis points each bring them at 4.85% and 2% respectively.

- Moreover, it has lowered reserve requirements by 50 basis points for banks which have sizable exposure to agriculture and small business sector.

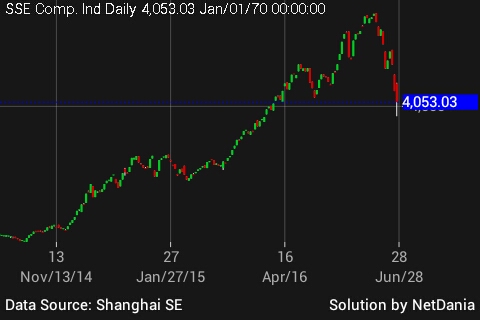

The Shanghai Composite was up 2.49 per cent in early trade after the People's Bank of China's decision over weekend to cut interest rates to a record low, but then sold off to be as much as 7.58 per cent lower. However the index finally closed down -3.34% to 4053.

Shanghai composite dropped more than 25% from its June peak.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?