Dollar has started the week in stronger footing, as most of the major counterparts retreated against dollar amid risk aversion arising from Greece negotiation and Italian election outcome.

- Euro is down 0.55%, Pound is down 0.43%, and Franc declined about 1%, while dollar index is up 0.36%, trading at 97.23. New Zealand Dollar is the only major counterpart that is up 0.41% against dollar. Yen is trading flat benefiting from risk aversion.

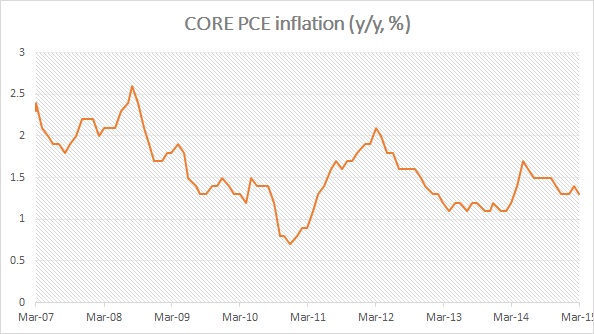

Today at 12:30 GMT, FED's favorite inflation indicator will be released from US, Personal consumption expenditure (PCE) inflation.

Past trends -

- After solid gains in 2014, US core PCE inflation has slowed down this year as lower oil prices resulted lower prices from producers' end due to lower input costs. After reaching as high as 1.7% in May 2014, inflation slowed to 1.3% in March 2015.

Expectations today -

- Market is expecting better reading today, since first quarter weakness is not expected to continue and rebound in oil prices are expected to have an impact on inflation pushing it higher.

Impact -

- Expect dollar, which is already performing strongly to gain further grounds if PCE data surprise on the upside, on the other weaker than expected release would push dollar sharply lower.

- Downside move might be limited, since lots of economic data scheduled this week from US including Non-farm payroll.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand