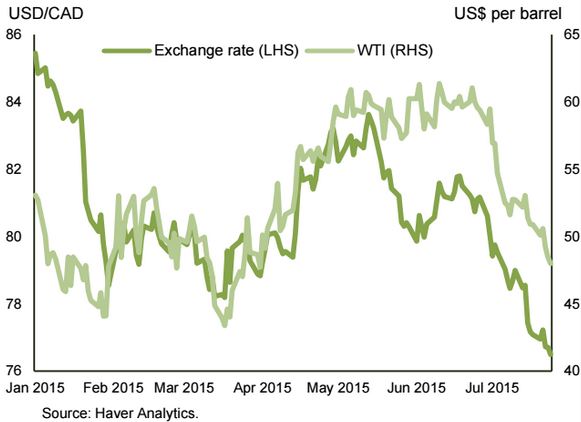

A variety of factors conspired to take the price of WTI below US$50 per barrel this week for the first time since March. When combined with last week’s Bank of Canada interest rate cut, this pushed the loonie under 77 US cents for the first time in over a decade.

Helping to round out some of the details on May’s economic performance, retail and wholesale trade data have reinforced our view that real GDP will be essentially flat in the month.

Add it all up and we are tracking a second quarterly contraction in real GDP in Q2 of roughly 1.0% (annualized). Looking beyond Q2, the lower Canadian dollar and interest rates should be supportive of growth, although the continued weakness in oil prices may delay renewed investment in the energy sector.

But looking beyond the second quarter, the lower Canadian dollar and lower interest rates bode well for Canadian exporters and manufacturers. Consumers should also to benefit. However, if current trends in commodity prices continue, business investment, particularly in the energy sector, may be slow to ramp up. The housing sector is likely to remain a bright spot in 2015, but can be expected to cool next year as affordability continues to erode on the back of national home price growth that is outpacing income growth. And with 5-year Government of Canada bond yields at around 80 bps, it’s hard to imagine rates going much lower.

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data