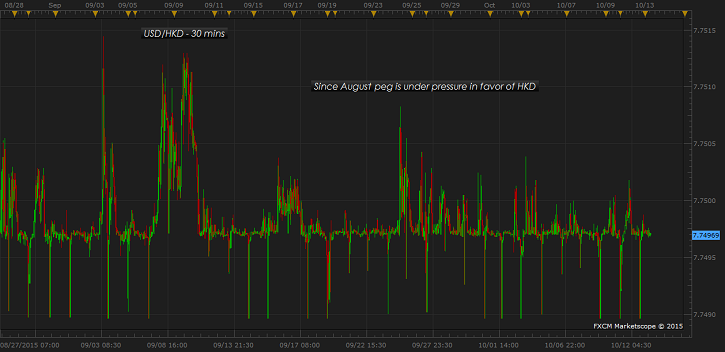

For almost a month Hong Kong Dollar peg is under strain on the strong side, prompting authorities to intervene in the market. Though, theoretically a central bank can protect a peg, on strong domestic currency side by selling unlimited amount of local currency, however that is not without a risk and practically can't be protected forever, as can be seen from Swiss Franc example.

Swiss National Bank (SNB) theoretically could have saved the EUR/CHF peg by selling unlimited amount of Franc but chose to abandon it before European Central bank (ECB) delivered €1.1 trillion quantitative easing. Balance sheet would have ballooned beyond 100% of GDP if it had chosen to maintain the peg.

However, HKD may not face similar fate, which have withstand test of time. The peg is in place since 1985, making it one of the oldest and most stable in history.

- But even if the peg withstands current pressure, Hong Kong economy is in a difficult spot due to the peg.

- Hong Kong authorities to protect the peg hikes and reduces interest rates in line with US Federal Reserve, which makes its central bank one of the most hawkish in the world.

- Due to its stability and standing as proxy for Dollar, Hong Kong economy encounters heavy inflow at a time of turmoil in the region. It has registered huge fund inflow from Russia, during recent currency turmoil in Russia.

- Moreover due to the peg it had to lower interest rates at a time when its economy was strong enough in 2008/09 and its neighbor China was exerting strength. That has led to rise in property prices almost 60% in last 5 years.

Now it faces much deeper problem over the peg.

- Thanks to the peg, it would have to raise interest rates at a time when its big neighbor and largest trading partner China is slowing down substantially. Latest report shows that China is reducing imports by -17.7% y/y as of September, which is likely to hit Hong Kong hard.

- Moreover it would likely to face greater inflows from China exerting pressure on the peg.

2016 is likely to be one of the toughest year for Hong Kong monetary authorities if Chinese economy slows further.

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings