Markit/CIPS composite PMI rises to 53.7 in September from 53.2 in August. UK service sector continued to recover from July’s EU referendum-induced shock, however, the rate of expansion slowed. September’s services PMI saw some slippage in the headline balance, easing to 52.6 from 52.9 in August, still exceeded the consensus expectation of 52.2. Data followed upbeat manufacturing and construction PMIs earlier in the week and re-affirmed that the immediate aftermath of the referendum has not proved as adverse for the economy as initially expected.

Details of the September report are in fact more reassuring about the near-term outlook. Companies reported new opportunities and customer enquiries, rising demand from overseas clients linked to the weak pound sterling and client confidence recovering after the initial Brexit vote shock. However, confidence about the year ahead remains low amid widespread Brexit-related uncertainty, and inflationary pressures continued to build as the weak pound pushed up import costs.

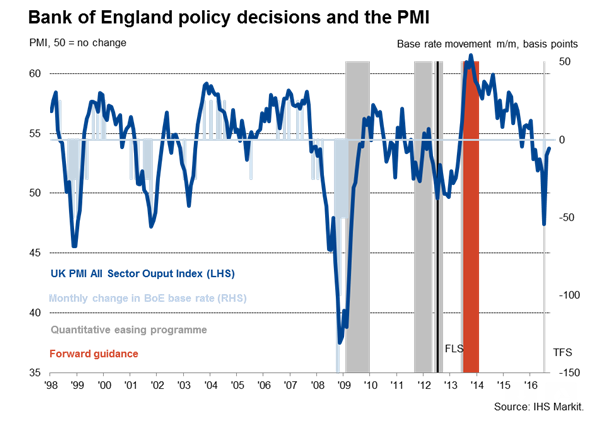

The improvement suggests the economy has regained growth momentum, recovering from the initial shock of the EU referendum in late-June. The risk of recession in the second half of 2016 has, therefore, all but evaporated, and the solid PMI readings for September will cast doubt on the need for any further stimulus from the Bank of England in coming months.

“Policymakers were offered much-needed positive news for September after the recent Brexit upheaval, as the service sector reported the fastest increase in new business since February this year. Though the overall activity index still remained below its long-term average and had dipped slightly compared to August, it reflected a modest revival of fortunes for services businesses," said David Noble, Group Chief Executive Officer at CIPS.

The International Monetary Fund has said the UK will be the fastest-growing major economy this year. It praised BoE actions post-Brexit for helping to "maintain confidence" in the economy. The IMF now expects the UK economy will grow by 1.8 percent this year - above its earlier forecast of 1.7 percent (which it issued in July) and puts the UK on track to be the fastest growing G7 economy this year.

GBP remains muted, under intense selling pressure after UK Prime Minister Theresa May's comments over the weekend spooked market fears of 'hard Brexit'. GBP/USD hits new record lows at 1.2685 on the day. The pair has recovered slightly to trade around 1.2726 at around 10:00 GMT. UK gilts plunged Wednesday after service sector growth beat expectations. The yield on the benchmark 10-year gilts rose 3 basis points to 0.819 percent, the super-long 40-year bond yield climbed 3 basis points to 1.547 percent and the yield on short-term 2-year bond bounced 1/2 basis point to 0.132 percent by 09:40 GMT.

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady