For the past month, looking at Euro/ Franc exchange rate, we have been speculating that Swiss National Bank (SNB) might be intervening in the market on regular basis to pop up Euro against Franc and to maintain some de-facto floor.

In January this year, SNB scrapped its Euro/Franc 1.2 floor, however seems to have maintained some de-facto floor around 1.02

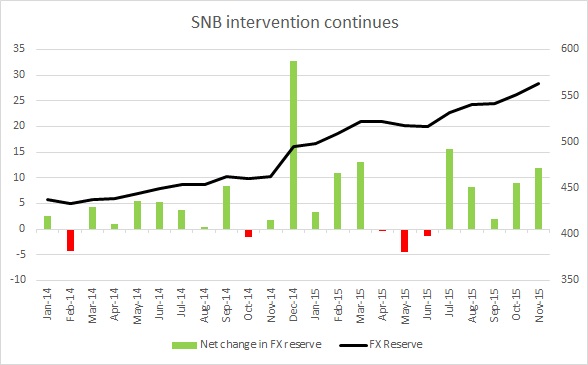

Today's FX reserve details from SNB somewhat confirmed that theory. The average intervention has been highest this year, since 2011/12 Eurozone crisis. Last month SNB FX reserve increased by $16 billion, highest since July, as speculation over further monetary stimulus from European Central Bank (ECB), went rampant.

Since July SNB FX reserve increased by $49.8 billion or $9.4 billion per month. However with ECB providing lesser than expected stimulus, SNB balance sheet is likely to increase at much slower rate at least in first half of 2016.

SNB balance sheet size is now close to 90% of GDP.

Franc is currently trading at 1.002 against Dollar.

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed