Today, from Australia, house price details were released for third quarter and it's not a pretty picture. Property prices are still on the rise, increasing the risks if meltdown occurs and making the properties away from regular people. Wage growth, certainly doesn't match, the kind of rise in Australia's property prices.

Reserve Bank of Australia (RBA) in recent days sounded more confident in its bid to reign on the risks from rising property prices. Latest report shows, while loans availed by homeowners on the rise, outstanding loans for investment purpose has declined by from $14 billion to $11.5 billion, still high compared to historical average.

However, property prices are still on the rise steadily, boosted by lower interest rates, lower exchange rates leading into rising foreign inflow to the market, especially from China.

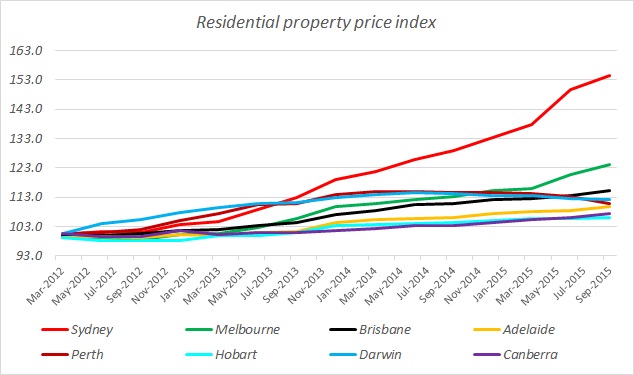

According to September report, Property prices are up 10.7% from a year ago in Australia, with Sydney accounting for biggest chunk of the rise (19.9%), followed by Melbourne (9.9%), Canberra (4%), Brisbane (3.8%), Adelaide (3.5%) and Hobart (1.7%). Perth and Darwin are only two cities, where prices have declined by -3.3% and -2% respectively, from a year ago.

With property prices, well beyond reach, we expect Reserve Bank of Australia (RBA) to keep policy rate at current 2% in H1, 2016 at least, without any adverse shock.

Aussie is currently trading at 0.725 against Dollar.

Replacing stamp duty with a land tax could save home buyers big money. Here’s how

Replacing stamp duty with a land tax could save home buyers big money. Here’s how  Stamp duty is holding us back from moving homes – we’ve worked out how much

Stamp duty is holding us back from moving homes – we’ve worked out how much  UBS "이 미국 도시, 부동산 거품 위험 가장 높아"

UBS "이 미국 도시, 부동산 거품 위험 가장 높아"  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  From NIMBY to YIMBY: How localized real estate investment trusts can help address Canada’s housing crisis

From NIMBY to YIMBY: How localized real estate investment trusts can help address Canada’s housing crisis  If you squat in a vacant property, does the law give you the house for free? Well, sort of

If you squat in a vacant property, does the law give you the house for free? Well, sort of  A ‘sponge city’ may be your home in 2050

A ‘sponge city’ may be your home in 2050