Recent disappointment from European Central Bank (ECB), over further stimulus has jolted the Euro/Dollar pair, big time and forced analysts, economists and market participants to the drawing board to revise their expected Euro/Dollar future path.

Analysts, including Goldman Sachs, FxWirePro had to revise calls for Euro/Dollar parity in the near term, even if isn't completely scrapped. Monetary policy is diverging and will keep diverging over next year, however not at the expected pace.

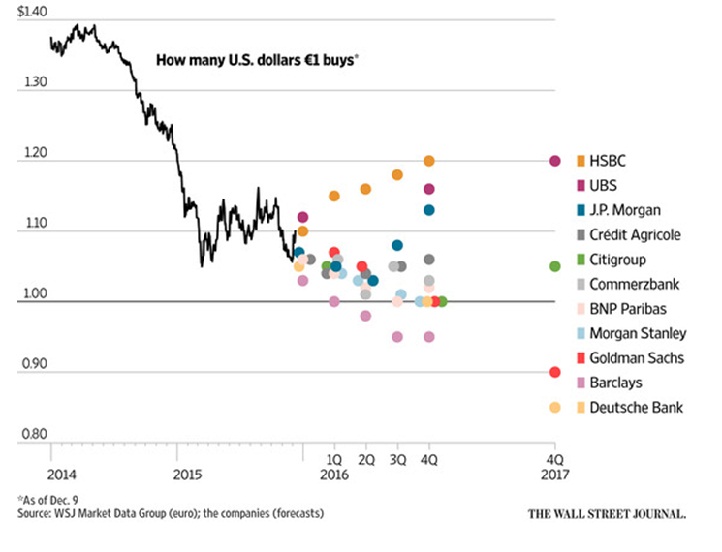

Survey by Wall Street Journal (shown in figure), shows investment banks are well divided in their expectations for Euro/Dollar path next year and beyond.

Bull group -

Three prominent investment banks, HSBC, UBS and J.P. Morgan expects Euro to trade and close above 1.10 mark by end of 2016. HSBC expects Euro to reach as high as 1.2 against Dollar, while according to UBS that level might take end 2017.

Bear group -

Bear group is much larger. Almost 11 investment banks expect Euro to fall at or below parity by next year. Deutsche Bank is most bearish, which expects Euro to drop to 0.85 against Dollar by end 2017, while Goldman Sachs expects it to fall to 0.9 by end 2017.

We, at FxWirePro, have not finalized on our longer term forecast, which we will do after tomorrow's FED. However, we expect in the near term, Euro has potential to move higher.

We have given call to buy Euro at 1.09 against Dollar and at dips, targeting 1.15 area. Upward push might even extend to 1.18 against Dollar.

Euro is currently trading at 1.101 against Dollar.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed