- Dollar rally has been fuelled by the prospect of a rate hike by Federal Reserve (FED) this year & by divergent monetary policy pursued by other major central banks.

- At one point it will be vital for the rates to affirm the speculative rise of Dollar. A chart & table explains the situation better.

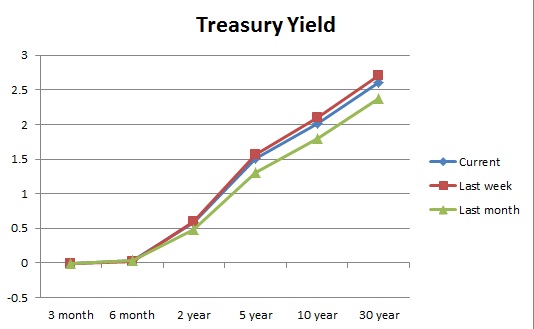

- Treasury yields have come a long way from last month and continue to boost the performance of dollar.

- Even then, the recent trend is of concern, treasury yields have started flattening somewhat despite the short term rates remained well anchored.

- Better data out of US last night couldn't boost the longer end of the curve to rise above last week's level. Seem like the comments from Janet Yellen still continue to weigh. Shorter end remained firm but struggling.

- Two year yield is failing to rise above 60 basis points decisively in recent market activity.

- Notably 5 year note auction on Wednesday yielded 1.48%.

- So far dollar has done well on the back drop of falling yield spread between US and other major economies but to continue the performance over the medium and long term, the treasuries would need to support.

- The curve's reaction would be vital to watch in today's release of US GDP and next week's NFP report.

The curve, especially the longer end is expected to get boost once the actual hike begins. The dollar might continue to perform well in the current circumstance.

|

Maturity |

Current |

Last week |

Last month |

|

3 month |

-0.01 |

-0.01 |

-0.01 |

|

6 month |

0.04 |

0.02 |

0.04 |

|

2 year |

0.59 |

0.6 |

0.49 |

|

5 year |

1.51 |

1.56 |

1.31 |

|

10 year |

2.01 |

2.1 |

1.8 |

|

30 year |

2.6 |

2.71 |

2.38 |

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand