The U.K Gilts continue to trade lower on Thursday as Bank of England (BOE) paints a hawkish picture by maintaining its stance that next move will be a hike in interest rates despite Brexit risk amid leaving the policy rate unchanged at 0.50 pct. Also, rallying crude oil prices drove-out investors from safe-haven assets. The yield on the benchmark 10-year bonds rose 3bps to 1.419 pct and the yield on 2-year bonds jumped 3bps to 0.405 pct by 1135 GMT.

The Bank of England left its policy rate unchanged at 0.50 pct, as expected and this decision was made from MPC 9-0 votes. The Bank of England's Monetary Policy Committee (MPC) sets monetary policy to meet the 2 pct inflation target and in a way that helps to sustain growth and employment. At its meeting ending on 11 May 2016 the MPC voted unanimously to maintain Bank Rate at 0.5 pct. The Committee also voted unanimously to maintain the stock of purchased assets financed by the issuance of central bank reserves at £375 billion. Twelve-month CPI inflation increased to 0.5% in March but remains well below the 2% inflation target. This shortfall is due predominantly to unusually large drags from energy and food prices, which are expected to fade over the next year. Core inflation also remains subdued, largely as a result of weak global price pressures, the past appreciation of sterling and restrained domestic cost growth.

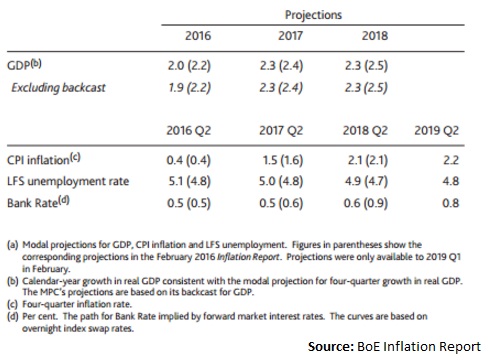

In addition, the BoE in its inflation report lowered its Q2 growth forecast to 0.3 pct, from 0.5 pct in its previous forecast. On the other hand, increased its inflation estimates for 2 years time to 2.07 pct, as compared to prior consensus of 2.05 pct. Moreover, the Bank of England in its MPC Minutes said that Spare capacity (slack) has risen slightly in latest report and wide range of views amongst MPC re direction of prices & slack. Said inflation remains subdued despite slight rise in Q1 and the MPC notes half of 9 pct currency drop blamed on Brexit risks; not mentioned previously. Governor warns that leaving EU will have material economic effect and could affect appropriate settling of monetary policy. Whatever Brexit outcome, MPC to take action as required and said referendum has hit housing & commercial market, they added.

Lastly, the BoE Governor Mark Carney said in the press conference after the policy decision that around half of 9% move in sterling is Brexit related and we have factored that out of forecasts and rate increase is more likely than not by the end of the forecast period and. Said uncertainty measures have picked up sharply in February and they could be over or underestimating the effects of Brexit. He further added that Brexit could lead to higher path of inflation and lower path of growth and monetary policy cannot immediately offset all the effects of a shock from Brexit.

The British gilts have been closely following developments in oil markets because of their impact on inflation expectations, which are well below the Bank of England's target. Today, the crude oil prices climbed after International Energy Agency said in its report that the global supply glut to shrink this year. They mentioned that non-OPEC output falling 800k barrel per day (bpd) in 2016, from previous forecast of 710k bpd as unplanned outages start to bite and global crude oil stocks to rise by just 200k bpd in the second half of 2016, as compared to 1.3 million bpd in first half. Nigeria, Libya and Venezuela have seen crude output fall 450k bpd from a year ago and further rally in oil prices to be tempered by brimming crude and product stocks, until more levels of inventory are reached, they added in a note. According to the US DOE, crude inventories decreased 3.4 million barrels, as compared to previous build of 2.8 million barrels for the week ending 6 May. This came alongside decreases seen in gasoline inventories of 1.2 million barrels, from prior 0.5 million barrels, also supported oil prices. The International benchmark Brent futures rose 0.90 pct to $48.02 and West Texas Intermediate (WTI) jumped 1.43 pct to $46.89 by 1215 GMT.

Meanwhile, The FTSE 100 rose 0.56 pct or 26.51 points to 6,189 by 1215 GMT.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX