- Supply glut continues to persist in the US. US oil inventories increased by 10.3 million barrels to 444.4 million barrels way more than average estimate of 4 million barrels and previous around 8.4 million barrels. This level is not seen in at least last 80 years.

- Inventory is increasing at a rapid rate despite refineries operating at 86.6% of the operable capacity and in spite of decline in import by 1.6 percent to 7.4 million barrels/day.

- US is exporting highest amount of oil products in many years and the production of crude still remains well above 9 million barrels/ day.

Capacity squeeze -

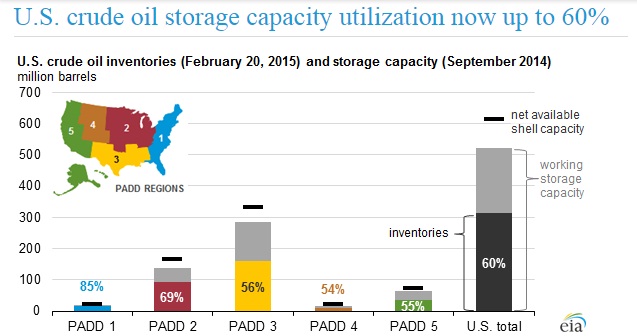

- The storage capacity in the US is coming to a full. The capacity in Cushing, Oklahoma is around 70 million barrels of which around 50 million is already full. At current pace of production it could run short within the year. Chart explains the situation across US.

- As it explains, the US total storage capacity is distributed across 5 PADD regions. PADD1 is 85% full followed by PADD2 (69%), PADD3 (59%), PADD5 (55%), PADD4 (54%) making the overall working capacity down by 60%.

Impact -

- Oil can be stored off shore in super tankers but that is an additional cost.

- Price may continue to remain depressed, especially the WTI spreads.

- Political debate over US crude export to heat up may be in favor of the companies looking to repeal the law of export ban.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand