The Russian Ruble continued to witness solid gains vs the US dollar after the Russian manufacturing sector signaled a solid improvement in operating conditions. Further, a stronger overall upturn was supported by accelerated growth in output and new orders.

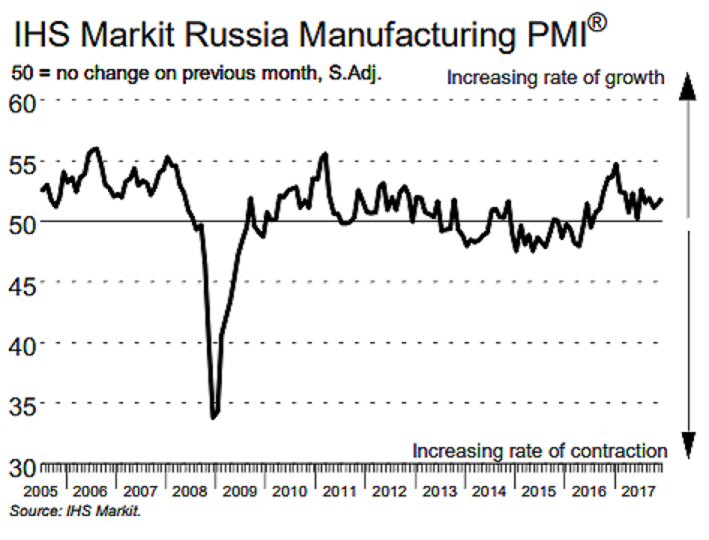

The seasonally adjusted IHS Markit Russia Manufacturing Purchasing Managers’ Index (PMI) posted 52.0 in December, up from 51.5 in November. The latest index reading signaled solid growth across the Russian manufacturing sector and reached a five-month high. The latest PMI was in line with the average for 2017 as a whole.

Greater demand from new and existing clients supported a solid increase in new orders received by Russian goods producers. Furthermore, the rate of growth quickened and was the fastest since July. Export sales, however, contracted for the first time since August, albeit only marginally.

However, inflationary pressures remained muted in the context of the series history, with rates of both input price and charge inflation softening despite supplier constraints delaying delivery times further. The rate of inflation eased to a four-month low despite vendor performance deteriorating to the greatest extent since July 2016. Average prices charged also increased at a muted pace, with the rate of inflation softening to a five-month low.

"In line with recent cuts in interest rates by the Russian central bank, inflationary pressures remained muted in the context of the series history. Moreover, the pace of both input price and output charge inflation softened despite greater supplier delays," said Sian Jones, Economist at IHS Markit.

As of 08:30GMT, USD/RUB traded 0.32 percent lower at 57.55. Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient