Peoples Bank of China (PBOC) since late last year has been providing policy stimulus, however that so far yielded no significant turnaround of weakening Chinese economy.

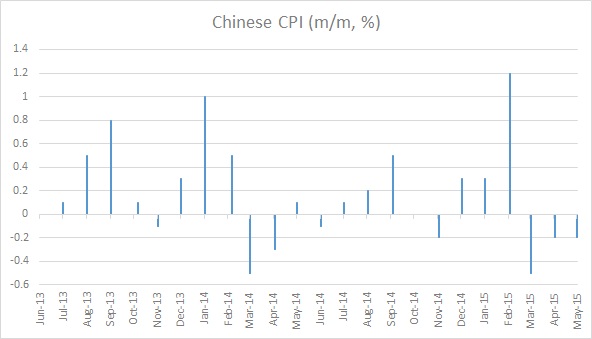

- Latest inflation reading showed inflation moved to negative in May on monthly basis to -0.2%, while it is still positive at 1.2% on yearly basis.

Key highlights of Chinese economy -

- Economy is unlikely to meet this year's growth target of 7% and definitely not going to meet inflation target of 3%.

- Latest statistics pointing at continued slowdown in economy. Weak domestic demand contributing to negative growth in producer prices, which dropped by -4.6% in May, from a year ago.

- In 2015, Chinese slowdown seems to have accelerated. Exports dropped 4 times in the first five months so far. In May imports dropped sharply by 17.6% from a year ago, after 16% drop in April.

- Latest PMI report showed, growth remains weak and deflationary pressure remains persistent.

PBOC will be reducing rates soon, however ailing economy is asking for more aggressive stimulus, also from fiscal side.

PBOC has already provided reserve ratio cut, lending rate cut and reduced margin to 40% from 60% for second house purchase, however more might be on the way.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary