All eyes are on the much awaited European Central Bank meeting today scheduled at 12:45 GMT, followed by press conference at 13:30 GMT, which could possibly trigger a chain of events across other central banks. What is expected or rather what the markets have priced in as a possible outcome from the ECB today is as follows:

-Money markets expect ECB deposit rate cut of at least 10bp

-QE to be upped to from E60bn to E75bn a month

-Some expect extending QE beyond current Sept 2016 end date

-A two-tier deposit rate system could also being considered

The odds of more stimulus increased yesterday after preliminary euro zone inflation data for November showed that prices rose a lacklustre 0.1%. However, uncertainty remains on Draghi's ability to over deliver, should Draghi fail to do so EUR shorts are likely to be squeezed. If on the other hand Draghi succeeds in beating market expectations, Euro bears would be buoyed, any large beating brings forth possibilities for parity.

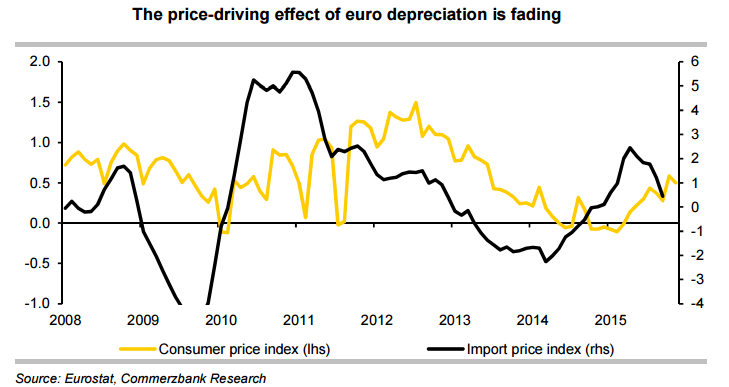

The doves in the ECB Governing Council on the other hand are likely to have noted the preliminary inflation data for November with a degree of satisfaction. The inflation rate stuck at 0.1%, but more important is the fall of the core inflation rate from 1.1% to 0.9%. This suggests that the price-driving effect of previous euro depreciation is gradually fading. There is a strong possibility that the ECB will revise down its medium-term inflation projections.

"We still expect the core inflation rate to be below, rather than above, 1% in the coming year too. The clear rise in the core inflation rate expected by the ECB so far to an average of 1.4% next year has become even more unlikely with today's data. We anticipate that the ECB will correct its forecast for core inflation downwards tomorrow and use this downward revision as grounds for deciding on further expansionary measures", says Commerzbank in a research note.

Pan-European stock markets rallied on Thursday as investors anticipate a fresh monetary stimulus from the ECB. Germany's DAX was up 0.90%, while France's CAC gained 0.70%, and the UK's FTSE not much behind was up 0.10%. The euro trades near session lows vs. the greenback, at 1.0558 as at 1100 GMT.

What is priced in from the ECB?

Thursday, December 3, 2015 11:26 AM UTC

Editor's Picks

- Market Data

Most Popular

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed