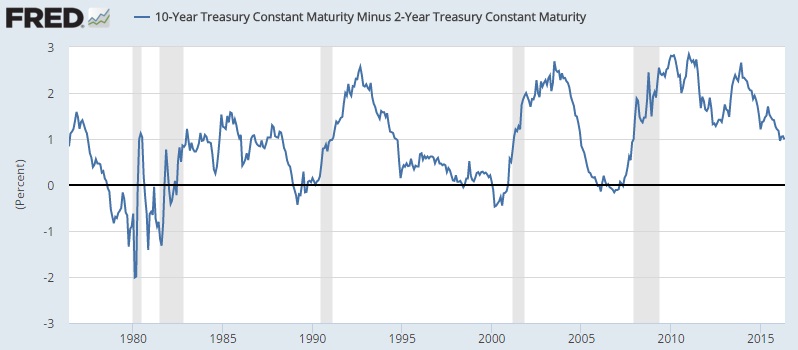

Over the past four decades and more, one reliable indicator has pointed to recession every time successfully and few years ahead. That indicators is the spread between short dated (2 year) and long dated (10 year) treasury yields.

The spread between 2 year and 10 year treasury yields dropped to just 95 basis points on Friday, which is the lowest level since late 2007, eve of great recession.

Every time that spread has dropped to negative, recession followed. Last time it was in negative was back in 2006, which was followed by Great Recession of 2008, before that back in 1999, which followed dot com bubble burst and U.S. recession of 2001.

Similar can be seen in prior recession too.

And biggest worries are, growth is already weak enough and central banks’ stimulus across globe at highest. There may be few tools left to Central banks’ arsenal to tackle such a situation and if triggers another global recession.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed