Mergers and Acquisition tend to pick up pace and reach its heights around stock market peak. So it works as a contrarian indicator. Managers and acquirer are most optimist around stock market peak.

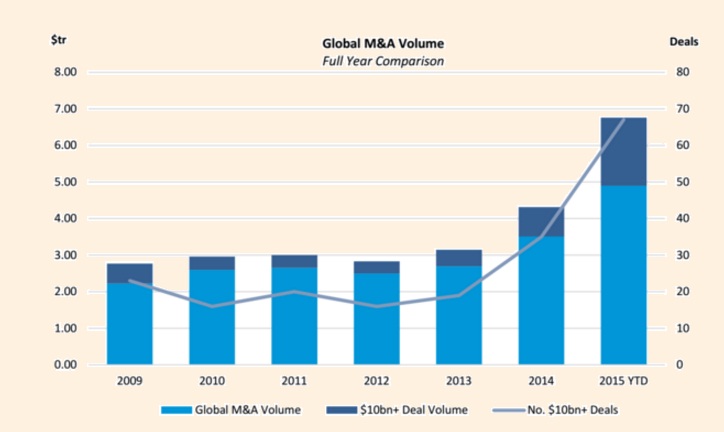

So this year's record mergers and acquisition deals are worrisome in that aspect. After $3.27 trillion deal in 2014, so far in 2015 total deal value has been $4.89 trillion according to calculations made by Dealogic. Chart courtesy is to Financial Times. This year's value outpaces, 2007 peak, which was at $4.12 trillion and fuelled by leverage buyout.

According to Dealogic, 67 deals this year has been worth more than $10 billion, totaling $1.86 trillion, more than 100% rise from last year's total. 9 deals have been worth more than $50 billion.

After long six years of bull market, US benchmark stock index, S&P 500 is on its way to yearly loss.

S&P 500 is currently trading at 2048.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX