XRP has surged past $3.00, rising 4.15% to hit $3.02 in early September 2025. This increase comes from a 99% chance of a Federal Reserve interest rate cut at the September 16-17 FOMC meeting and a new custody deal with BBVA. The expected rate cut, possibly up to 50 basis points due to weak employment data from August, is weakening the U.S. dollar. This is helping risk assets like cryptocurrencies. XRP is outperforming Bitcoin, Ethereum, and Dogecoin.

The Ripple-BBVA partnership now provides complete custody services for Bitcoin, Ethereum, and XRP under the EU's MiCA framework. This solidifies XRP's role in banking and cross-border payments. Despite a rise in exchange inflows, large wallet holders have added 340 million XRP recently. This points to long-term confidence, especially with potential XRP ETF approvals coming in October 2025. The wider crypto market is also attracting strong institutional interest, as Bitcoin ETFs have seen $246 million in net inflows.

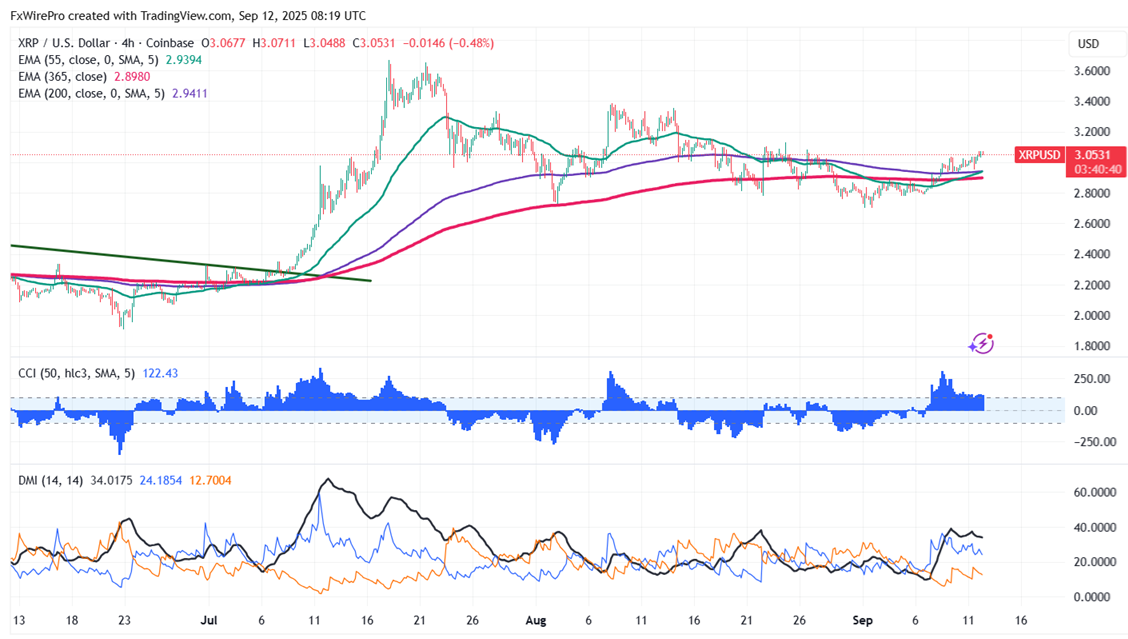

Resistance and Support Analysis

XRPUSD showed a minor jump above $3 on positive developments. The immediate resistance level for XRP is around $3.40, and a breakout above this level will push prices higher to $4/$5. Any breach above $5 confirms further bullishness, a jump to $7. On the downside, immediate support lies at $2.60; any break below targets $2.25/$2/$1.60, $1.27, $1.00, $0.85, and $0.74.

CCI(50)- Bullish

Directional Movement Index - Bullish

Trading Strategy Recommendation

It is good to buy on dips around $3 with SL around $2.60 with SL around $4/$5.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary