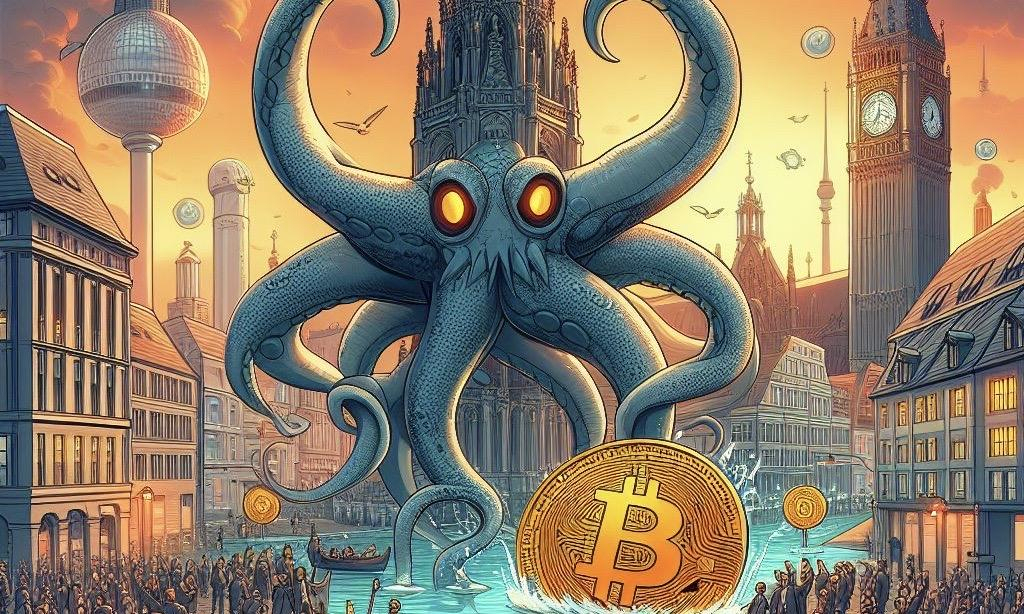

Cryptocurrency giant Kraken makes waves with its strategic decision to launch operations in Germany, a pivotal move in its broader European expansion plan. Teaming up with DLT Finance, a regulated financial institution, Kraken aims to offer tailored crypto solutions to meet the diverse needs of German investors.

Kraken's German Expansion

In a stunning development, Kraken, a worldwide known CEX, recently announced plans to begin operations in Germany as part of its European expansion, Coingape reported. In collaboration with DLT Finance, a regulated financial institute and custodian for digital assets, the CEX intends to provide various innovative crypto products, each adapted to German clients' specific needs and preferences.

This move by the cryptocurrency exchange is an attempt to broaden its global footprint. Let us take a closer look at the company's official announcement.

On May 6, Kraken said that it wants to establish a presence in one of Europe's important markets, Germany, through cooperation with DLT Finance. Furthermore, beginning July 10 of this year, the business plans to present a nationwide stockpile of cryptocurrency-related services.

DLT Finance, a subsidiary of the well-known BaFin-licensed crypto services providers DLT Securities GmbH and DLT Custody GmbH, aims to change the German crypto market.

Once the agreement is operational, DLT Finance will streamline specifically designed skills and infrastructure to meet the demands of millions of Germans and provide secure and compliant crypto services.

Kraken CEO David Ripley commented on the relationship: "Collaborating with industry-leading partners is a critical aspect of our objective to drive the worldwide adoption of cryptocurrency. With over 5% of Germans already owning crypto assets, we are confident in the potential of our innovative product suite." He also stated that "along with excellent local language client service support - will be appealing to prospective clients as crypto continues to become more mainstream across Europe."

Strategic Partnership

As reported by CoinGape Media earlier this year, Kraken even obtained a Virtual Asset Service Provider (VASP) registration from the Dutch Central Bank. This is consistent with CEX's European expansion objectives, as the company now has legal rights to offer its top-tier crypto services to Dutch residents.

Meanwhile, this story appears to have fueled the global rivalry between recognized cryptocurrency exchanges.

Photo: Microsoft Bing

FxWirePro- BTCUSD Daily Outlook

FxWirePro- BTCUSD Daily Outlook  CPI Report Spurs Optimism, BlackRock CIO Forecasts Fixed Income Growth

CPI Report Spurs Optimism, BlackRock CIO Forecasts Fixed Income Growth  Venezuela Acts Tough on Crypto Mining Amid Energy Squeeze, Disconnects Bitcoin Farms

Venezuela Acts Tough on Crypto Mining Amid Energy Squeeze, Disconnects Bitcoin Farms  Binance Enhances SHIB, USTC, AGIX Trading and Liquidity for Better Market Dynamics

Binance Enhances SHIB, USTC, AGIX Trading and Liquidity for Better Market Dynamics  Whales Bag $61M Profit as RNDR Price Rallies Over 3%

Whales Bag $61M Profit as RNDR Price Rallies Over 3%  Giga Shiba Inu Whales Shift 3.5 Trillion SHIB, Boosting Market Activity

Giga Shiba Inu Whales Shift 3.5 Trillion SHIB, Boosting Market Activity  Vanguard’s New CEO Says Bitcoin ETF Not on the Table: Report

Vanguard’s New CEO Says Bitcoin ETF Not on the Table: Report  US Orthodontic Leader Accepts Shiba Inu, Embracing Cryptocurrency for Payments

US Orthodontic Leader Accepts Shiba Inu, Embracing Cryptocurrency for Payments  Tesla Cybertruck Powers Houston Gas Station, Elon Musk Reacts to Saudi Prince’s Photo

Tesla Cybertruck Powers Houston Gas Station, Elon Musk Reacts to Saudi Prince’s Photo  Tether's $1B USDT Mint Boosts Bitcoin, Eyes on $70K Milestone

Tether's $1B USDT Mint Boosts Bitcoin, Eyes on $70K Milestone  FLOKI Price Soars 14% After Revolut Listing, Market Rally Anticipated

FLOKI Price Soars 14% After Revolut Listing, Market Rally Anticipated  OpenAI Disbands Team Tackling AI Risks Amid Leadership Changes and GPT-4o Launch

OpenAI Disbands Team Tackling AI Risks Amid Leadership Changes and GPT-4o Launch  Dovish CPI Inflation Boosts AI Coins--Is WienerAI The Top Crypto Pick?

Dovish CPI Inflation Boosts AI Coins--Is WienerAI The Top Crypto Pick?  Altcoins Expected to Yield 2x-5x Gains by May End: Fetch.AI, Floki, AAVE, ENA

Altcoins Expected to Yield 2x-5x Gains by May End: Fetch.AI, Floki, AAVE, ENA  FxWirePro- Ethereum Daily Outlook

FxWirePro- Ethereum Daily Outlook  OpenAI Founders Sam Altman and Greg Brockman Defend After Safety Researchers Quit

OpenAI Founders Sam Altman and Greg Brockman Defend After Safety Researchers Quit  Analyst Predicts Ethereum ETF to Trigger Major ETH Market Moves Soon

Analyst Predicts Ethereum ETF to Trigger Major ETH Market Moves Soon