Decentraland is a virtual reality platform powered by the Ethereum blockchain. Users can create, experience, and monetize content and applications. It is not controlled by a centralized organization.

Decentraland protocol is composed of three layers

Consensus layer- It helps to track land ownership and its content. It will use an ETH smart contract to maintain a ledger of ownership for non-fungible digital assets called LAND.

Land content layer - Their main use is to download assets using a decentralized distribution system.

Real-time layer - this layer helps to interact between users.

Land ownership is established at the consensus layer, where land content is referenced through a hash of the file's content.

Key compenent of Decentraland -

LAND- Land is a non-fungible, transferable, scarce digital asset stored in an Ethereum smart contract. It can be bought by burning fungible ERC 20 tokens called MANA.

LAND Parcel- It is a non-fungible (NFT, ERC 721), which cannot be forged or duplicated. It can be bought and sold on the marketplace.

Estate- Two or more adjacent LAND parcels form an estate. This can also be bought and sold on the marketplace.

Avatars- The digital representations of actual people in the virtual world.

Builder Tools are only available on desktops which helps to create 3D content within decentraland.

Total LAND- 90601 (43689 private land parcels, 33886 district LAND, 9438 roads, 3588 plazas)

Each LAND size- 16m*16m square spaces.

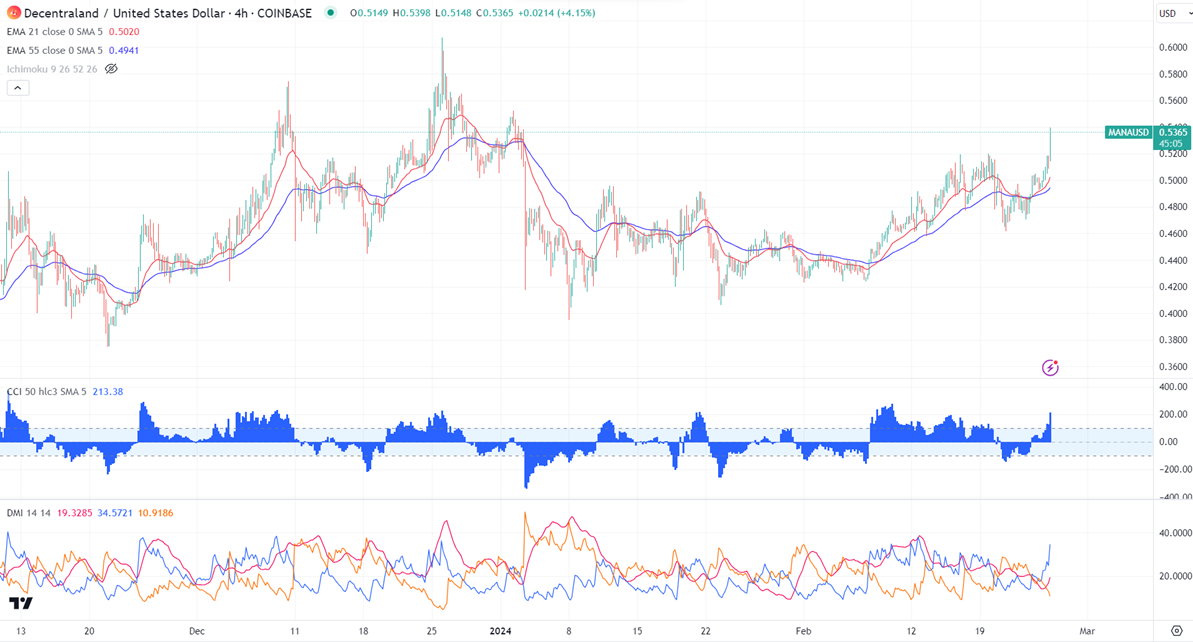

MANAUSD surged more than 15% in the past five days. The pair holds above the short-term (21 and 55 EMA) and above the long-term moving average. It hit a high of $0.5398 and is currently trading around $0.5373.

The bullish invalidation can happen if the pair closes below $0.2600. On the lower side, the near-term support is $0.50. Any break below targets $0.455/$0.390. Significant downtrend if it breaks $0.260.

The pair's near-term resistance is around $0.610. Any breach above confirms minor bullishness. A jump to $0.80/$1 is possible. A surge past $1.20 will take it to $2.

It is good to buy on dips around $0.450 with SL around $0.260 for TP of $1/$1.20.

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty