On the back of formidable economic data and the improved outlook for both domestic and foreign demand, we have revised our calls on GDP dynamics, the labor market, CNB policy, and the financial markets. We now expect two CNB hikes in 2017 (on 3 August and subsequently in 4Q’17), and three more hikes in 2018. The koruna is set to appreciate to EURCZK 25.70 in 3Q’17 and to EURCZK 25.00 by end-2018.

CZK is around 5% undervalued based on our BEER and FEER models. While the already long CZK positioning may prove a hurdle for short-term appreciation (the latest JPM Client Survey shows investor longs remain at record highs), we think the currency will find support from a central bank that is gradually turning hawkish.

We continue to hold shorts in EURCZK forwards exchange contracts of 27-Nov-17 expiries. The call is revised our end-2017 EURCZK forecast up to 25, given the lower than expected volatility of the currency post floor removal.

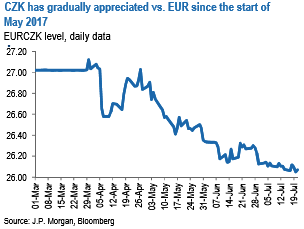

Further robust domestic macroeconomic performance and a forthcoming CNB rate hiking cycle reinforce our bullish koruna stance. The koruna has steadily appreciated against the euro since the start of May (following the exit of the EURCZK floor on 6th April), briefly trading below 26.00 this week (refer above diagram). We expect further appreciation of the currency and hold existing allocations and trades.

Starmer’s China Visit Highlights Western Balancing Act Amid U.S.-China Rivalry

Starmer’s China Visit Highlights Western Balancing Act Amid U.S.-China Rivalry  S&P 500 Rises as AI Stocks and Small Caps Rally on Strong Earnings Outlook

S&P 500 Rises as AI Stocks and Small Caps Rally on Strong Earnings Outlook  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Japan Finance Minister Defends PM Takaichi’s Remarks on Weak Yen Benefits

Japan Finance Minister Defends PM Takaichi’s Remarks on Weak Yen Benefits  U.S. Stock Futures Slip as Markets Brace for Big Tech Earnings and Key Data

U.S. Stock Futures Slip as Markets Brace for Big Tech Earnings and Key Data  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  OCBC Raises Gold Price Forecast to $5,600 as Structural Demand and Uncertainty Persist

OCBC Raises Gold Price Forecast to $5,600 as Structural Demand and Uncertainty Persist  India Budget 2025 Highlights Manufacturing Push but Falls Short of Market Expectations

India Budget 2025 Highlights Manufacturing Push but Falls Short of Market Expectations  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Markets React as Tensions Rise Between White House and Federal Reserve Over Interest Rate Pressure

Markets React as Tensions Rise Between White House and Federal Reserve Over Interest Rate Pressure