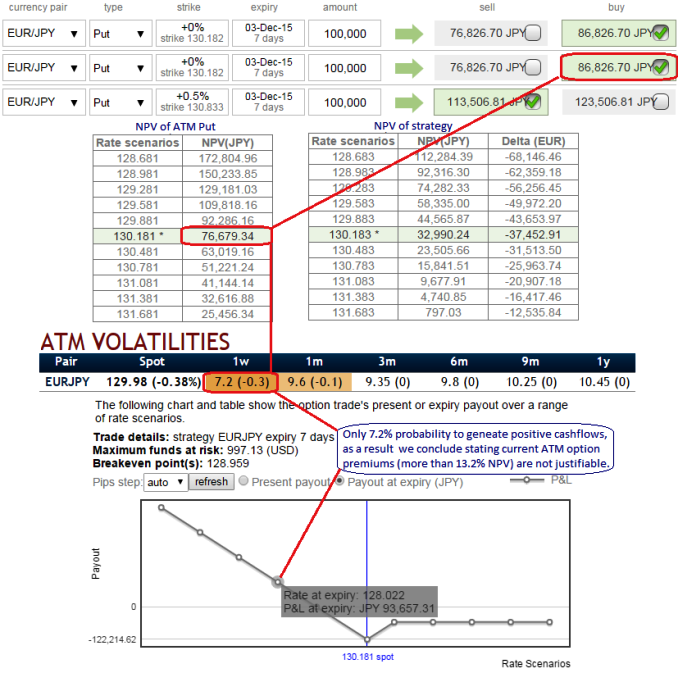

Please observe the IV factor for ATM contracts with 1w expiries. It is creeping down from last week's 8% to 7.2% for 1 week maturities.

On the flip side, EURJPY ATM puts are priced 13.22% above NPV which would mean that as shown in the diagrammatic representation, in order to generate the positive cash flows there is only 7.2% probabilities of ATM puts.

Hence, we believe there exists the disparity between vols and premiums and accordingly Put Ratio back Spread strategy is on competitive advantage than naked contracts or strips through option writings.

The delta risk reversal numbers are also getting higher negative values gradually in a long run (flashing at -0.25 for 1 week expiries).

Hedging activities of downside risks are mounting up, as a result Put options seem costlier.

Volatility smiles most frequently tells that traders are willing to pay higher implied volatility prices as the strike price grows aggressively out of the money.

The current spot FX is trading at 130.214 and it has been moving as per our previous technical assessment, we will continue to remain bearish with near targets extending dips up to 131.035 levels.

So, the recommendation for now is to add an extra long on put with 1M expiry any debit put spreads.

Strategy goes this way, Long 2 lots of 1M ATM -0.49 delta put and simultaneously short 1 lot of 3D (0.5%) ITM puts with positive theta values (for demonstration purposes only we've used identical expiries, use shorter expiries on short side).

With these narrow strike differences, the profit potential is greater, so that the ratio needed is also lower to profit on underlying movement.

Caution: If you think the pair is going to crash, you should be loading up on put buys in existing strategy. The total cost of the trade is going to be the difference between the prices of the two options. (Compare total cost with strips which involves 3 long sides whereas backspreads have 2 but then caps both directions when IV is increasing).

FxWirePro: Disparity between EUR/JPY IVs and ATM premiums – use backspreads i/o naked contracts or strips

Thursday, November 26, 2015 7:26 AM UTC

Editor's Picks

- Market Data

Most Popular