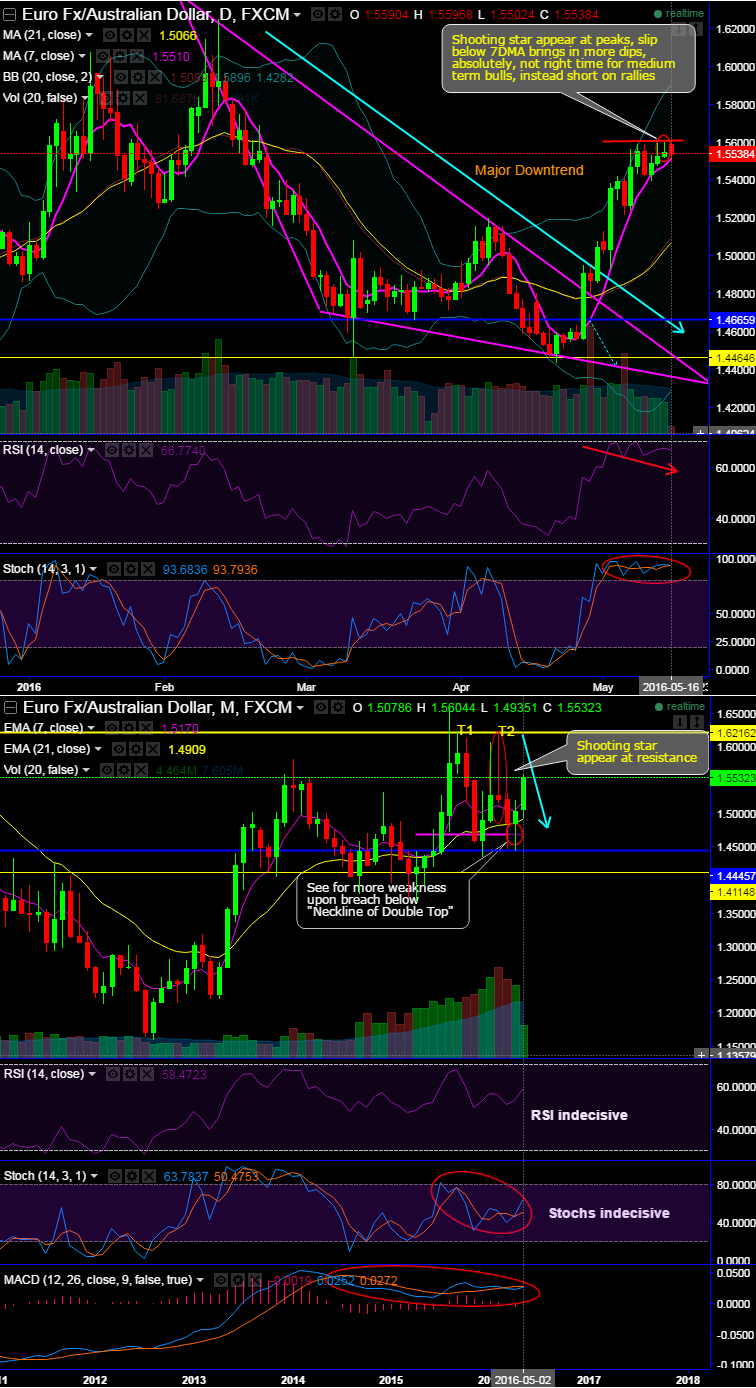

The shooting star candle pattern occurred at 1.5547 levels on daily & at 1.5223 levels on monthly plottings, more bearish swings have been evidenced as a confirmation (see next bear candle after this pattern).

Although the pair has been spiking from last fortnight or so (perhaps, the effects of RBA intervention) , it has tumbled earlier to break below major supports 1st at 1.5496, secondly at 1.5269, thirdly at 1.5060 and now at 1.4855 levels after the formation of this shooting star pattern (see monthly charts), now convincing trend direction from last couple of months.

But it resembles like double top formation on monthly.

For now, it has tested minor resistance at 1.5605 levels from last couple of days and rejected from that levels.

Both leading oscillators popping up with overbought indications. RSI is diverging to the previous rallies above 70s, while stochastic is also attempting for %D crossover above 80s.

Currently, prices are sliding, see more bearish rout upon drop below 7DMA.

Observe robust volume build ups on such non-directional trend.

We think, in a long term bearish sentiments remains intact , while buying sentiments are cushioned by RBAs easing cycle.

Both leading and lagging indicators are absolutely indecisive of puzzling trend.

Trading tips:

Intraday speculators can eye on one touch binary puts as the pair struggles above 1.5605 levels, it is good to buy at every rally and bring in leveraging effect using 'One touch binary puts' with OTM strikes for a minimum targets of 30-35 pips with ease.

The payoffs of touch option has been conditional, if EURAUD in this case would touch the OTM strike price within any time period by the time of expiration, if the investor predicts correctly and the asset touches the strike price the option expires "in the money".

So, the trading recommendation would be good to go short in near month futures contracts for targets below 1.53 levels or below with strict stop loss at 1.5686 levels. The short futures position is also used by traders to lock in a trading price of a FX that he is going to sell in the future.

Please be noted that as the expiry period approaches, the futures price converges to the spot FX of EURAUD.