Technicals Watch: This week’s price bounces have now tested and rejected resistance at 124.445 levels (daily charts), that’s where a “Shooting Star” pattern occurs, as a result, we see bears resuming again, current prices testing supports at 123.6212 (21DMA), slide below 21DMA to bring in more slumps. On a broader perspective, the current prices remain below EMAs despite attempts of bounces; downtrend has been slipping through falling wedge formation on monthly charts.

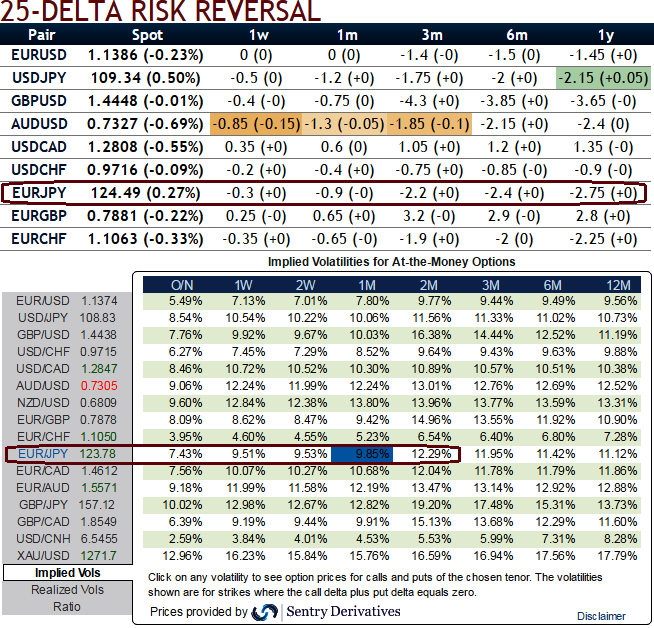

OTC Updates: The implied volatility of ATM contracts is at 9.51% for 1w expiries and inching higher at 9.85% for one month tenors which is edging higher again in long run.

As you can see delta risk reversals are indicative of participants in this pair are more concerned about further slumps especially from next 3 months timeframe. Rising negative flashes indicates active hedging sentiments for these downside risks.

25-delta risk reversal reveals the difference in volatility, and therefore price, between puts and calls on the most liquid out-of-the-money (OTM) options quoted on the OTC market, subsequently, the put are the expensive comparatively to the calls.

Acknowledging the gradual increase in the implied volatility of EURJPY but with higher negative risk reversals in long run is justifiable when you have to anticipate forwards rates and observe the spot curve of this pair (see IVs, RR nutshell, Sensitivities, and compare with spot prices).

Major trend is declining trend, from last two years or so the pair has consistently evidenced price slumps more than 17%, and we could still foresee more downside potential ahead.

Hedging Positioning:

Weighing up above aspects, we eye on loading up with fresh longs for long term hedging, more number of longs comprising ATM instruments and ITM shorts in short term would optimize the strategy.

So, the execution of hedging positions goes this way:

“Short 2W (1%) OTM put option, go long in 2 lots of 1M ATM +0.49 delta put options, thereby net delta should remain at around -0.66.”

We used narrowed expiries so as to suit the OTC market trends and to reduce the hedging cost. The quantum in above mentioned strategy is just for demonstration purpose only, one can load up weights according to the FX exposure in their portfolio.