• GBP/AUD declined on Monday as investors awaited cues from the Federal Reserve this week amid the recent rise in U.S. Treasury yields.

• Markets expect the U.S. central bank to build on comments by Treasury Secretary Janet Yellen of only small inflation risk with growing employment.

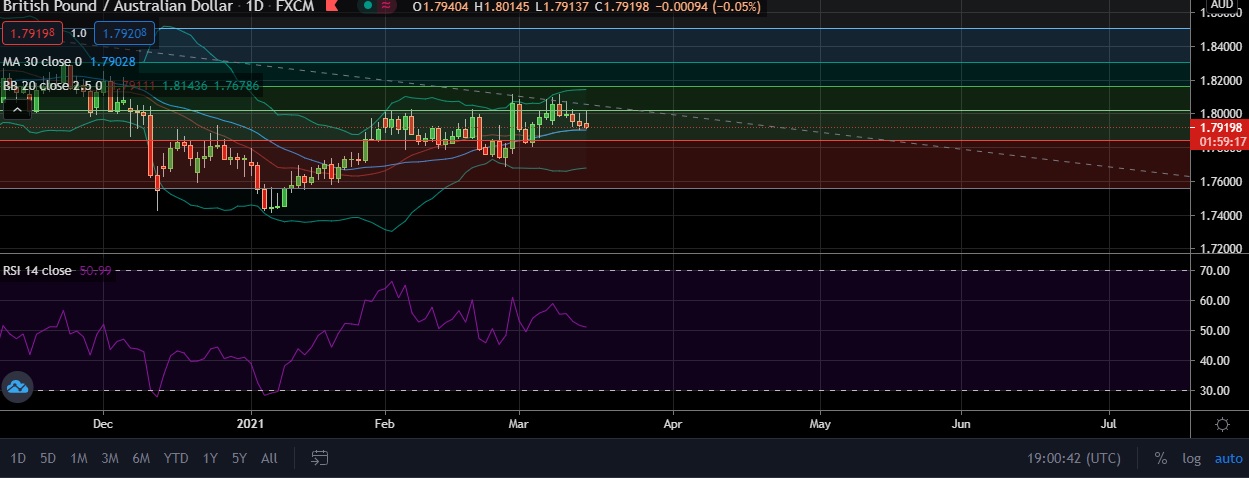

• The pair is currently approaching key support at 1.7900 (30 DMA ). A break under 1.7900 would unmask 1.7835 level in the short term.

• Technical are bearish, daily RSI is turning negative , daily momentum studies 5 and 9 DMAs are trending down.

• Immediate resistance is located at 1.8028 (38.2%fib ), any close above will push the pair towards 1.8129(Higher BB).

• Strong support is seen at 1.7900(30DMA) and break below could take the pair towards 1.7843 (23.6%fib).

Recommendation: Good to sell on around 1.7950, with stop loss of 1.8050 and target price of 1.9860