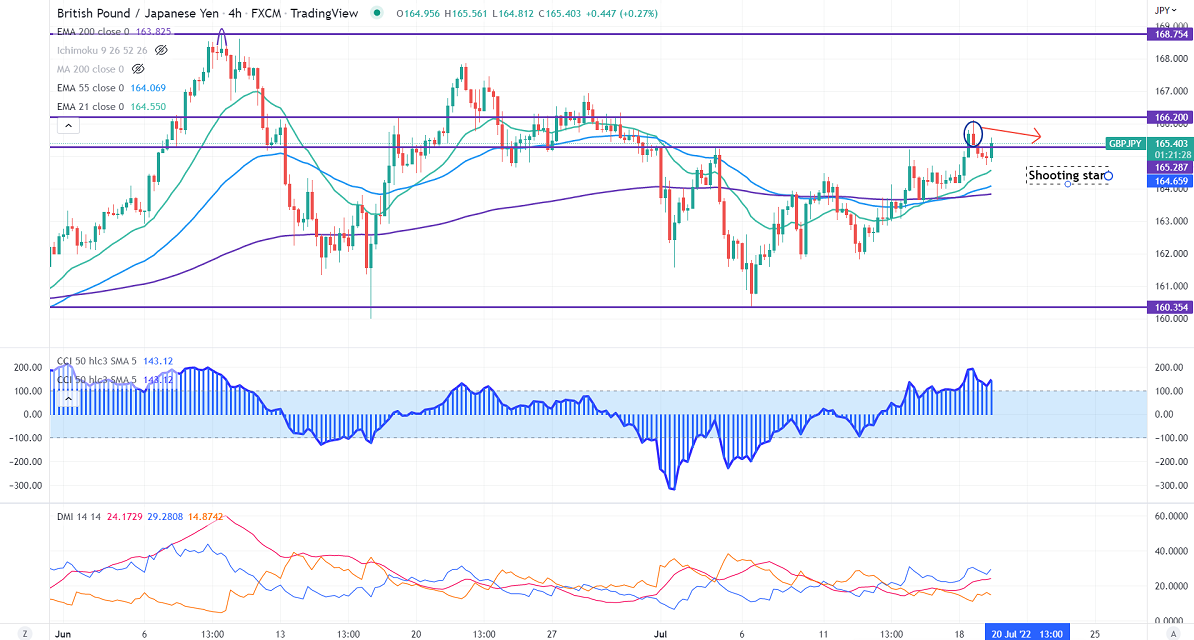

Candlestick pattern- Shooting star

GBPJPY pared some of its gains made yesterday on the strong yen. It gained against the US dollar after Fed Governor Christoper Waller and St.Louis President Jim Bullard said that they are not in favor of big rate hikes. UK economy has added 296000 jobs and the unemployment rate held at 3.8% in the three months to May. The pound sterling gained after the upbeat jobs data. Any jump above 1.2000 confirms a bullish continuation. Technically in the 4-hour chart, the pair is holding above short-term 21-EMA, 55 EMA, and long-term 200 EMA (163.72). Any breach above 165.50 will take to the next level to 166/167. GBPJPY hits an intraday high of 165.347 and is currently trading around 165.342.

The near-term support is around 164.45, any breach below targets 163.80/163.50/163.

Indicators (4-hour chart)

CCI (50) - Bullish

ADX- Bullish

It is good to sell on rallies around 166.10-15 with SL around 167 for TP of 163.