Ichimoku analysis (Daily Chart)

Tenken-Sen- $1835

Kijun-Sen- $1825

Gold jumped more than $50 from a minor bottom around $1785 on weak US dollar. US dollar index lost more than 70 pips from a high of 91.60 on upbeat market sentiment due to aggressive stimulus hopes. The minor sell-off in US bond yield from multi-year high is also supporting the yellow metal.

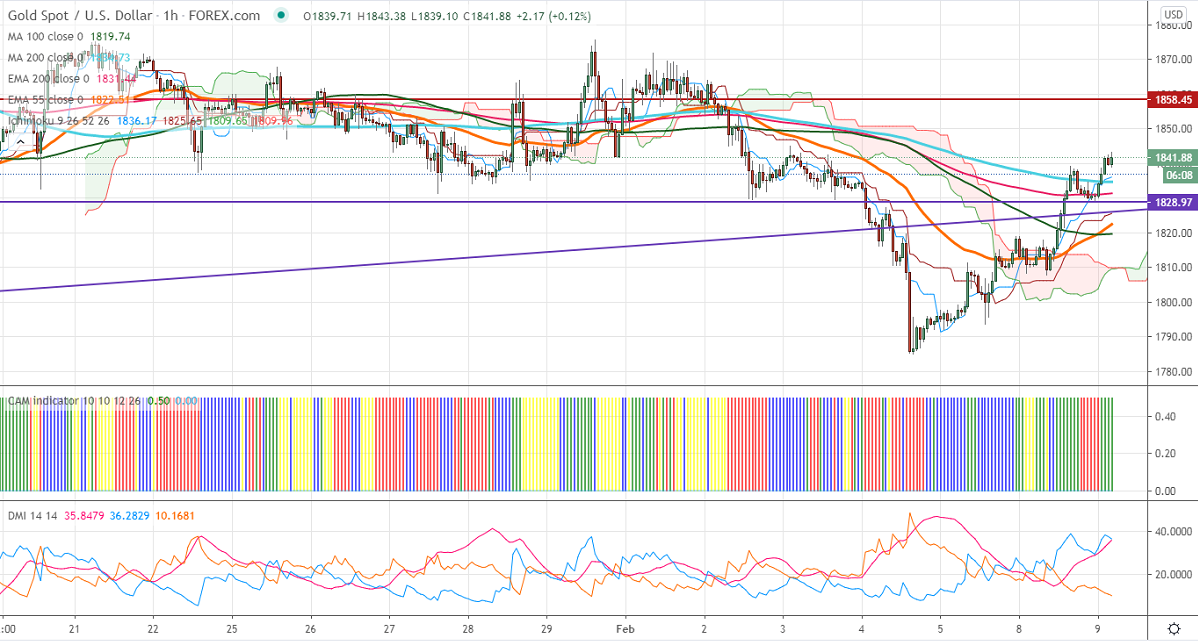

Technical:

The yellow metal is holding well above 200- H MA at $1835. It confirms minor bullishness, a jump till $1875/$1900 likely. On the lower side, near term support is around $1820, any indicative break below that level will take till $1800/$1780.

It is good to buy on dips around $1832-33 with SL around $1818 for the TP of $1900.