FxWirePro- Gold Daily Outlook

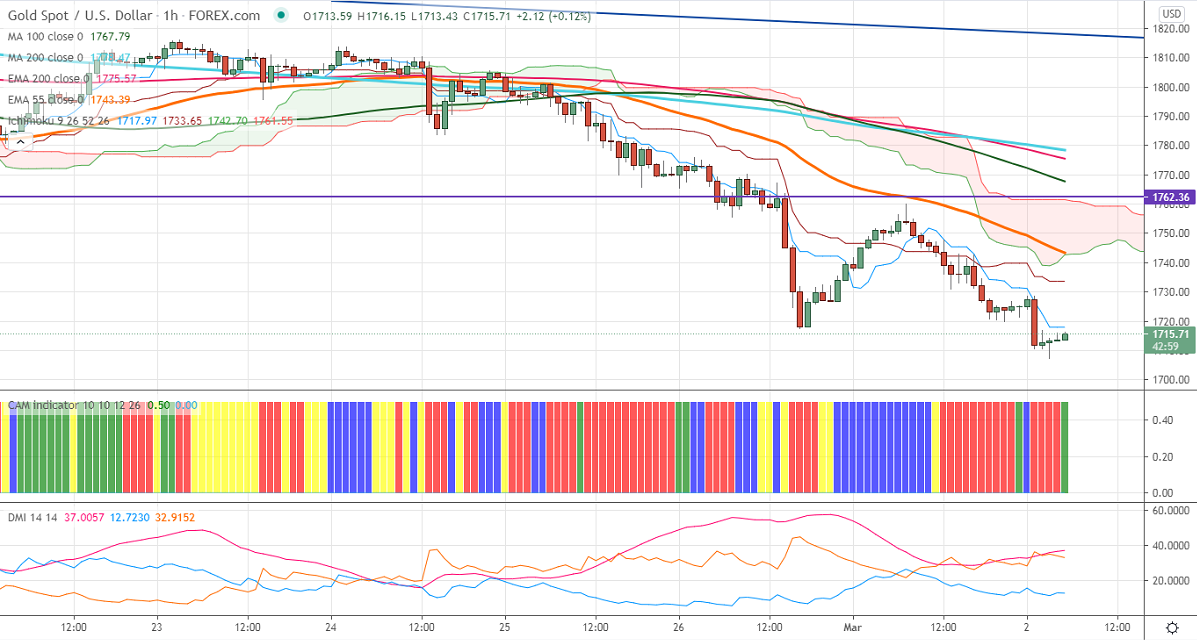

Ichimoku analysis (Hourly chart)

Tenken-Sen- $1717.95

Kijun-Sen- $1733.95

Gold is trading weak for the fourth consecutive day and lost more than $100 on surging US bond yield and strong US dollar index. The US 10- year yield lost more than 10% after hitting a multi-year high of 1.56%. The US dollar index is holding well above 91 levels, any violation above 91.60 targets 92.50.

Economic data:

US ISM manufacturing index came at 60.8% in Feb up by 2.1 percentage points from Jan 58.7%, slightly better than the forecast of 58.7%.

Technical:

It is facing strong support at $1700, violation below targets $1700/$1637. On the higher side, near-term resistance is around $1745, any indicative break above that level will take till $1760/$1779/$1800.

It is good to sell on rallies around $1728-30 with SL around $1750 for the TP of $1650.